Understanding Key Fees in Cross-Border Freight Transport: Drayage, Customs Broker Fees, and Duties

North America, comprising Canada, the U.S., and Mexico, represents one of the world’s largest trade blocs. However, navigating the complexities of cross-border freight transportation, especially through the U.S.-Mexico border, can be challenging. In this blog post, we’ll clarify three often-misunderstood fees associated with border-crossing freight transport: drayage or transfer fees, customs broker fees, and duties and taxes.

Cross-Border Freight Transport Overview

Cross-border freight transport encompasses the processes, activities, and infrastructure needed to move goods across international borders efficiently and legally.

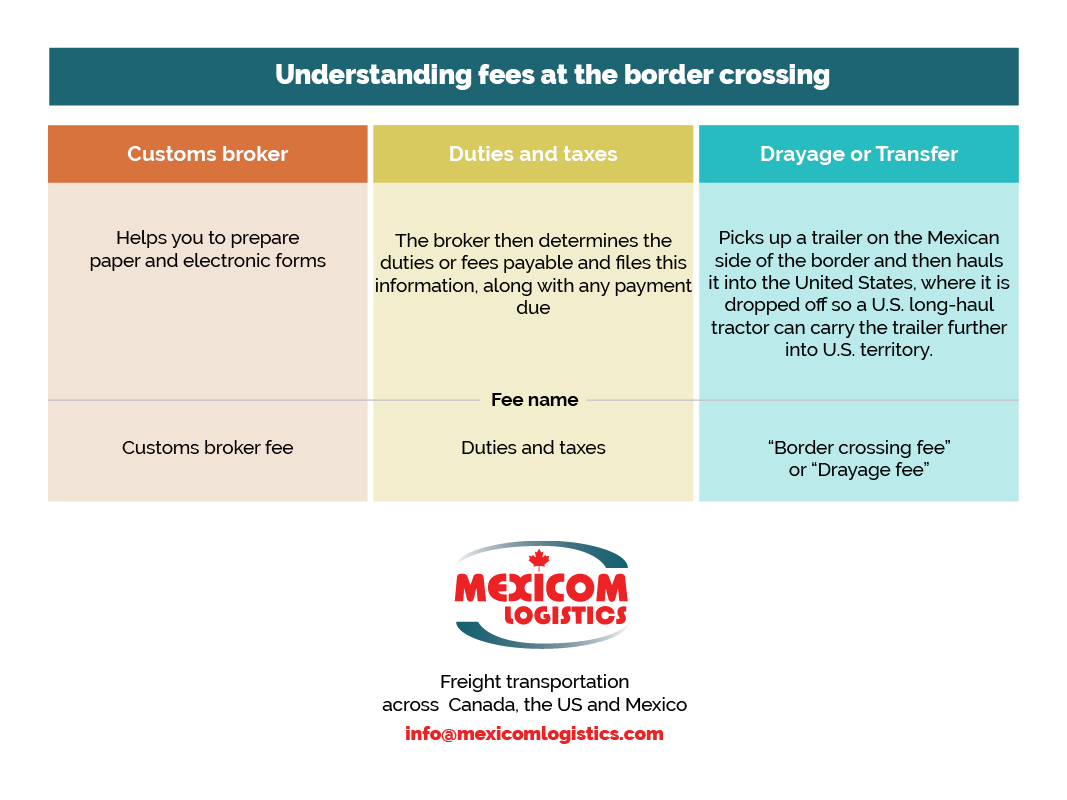

1. Customs Broker Fee vs. Drayage or Transfer Fee

Customs Broker Fee:

A customs broker plays a crucial role in facilitating the border-crossing process. They handle:

- Preparation of necessary paper and electronic forms required by both Mexican and U.S. Federal agencies.

- Staying updated with current customs regulations and procedures, including any recent changes.

- Ensuring that all export documentation required by Mexican and U.S. Customs is correctly prepared.

The fee for these services is known as the customs broker fee.

Recommended article: [CHECKLIST] EVERYTHING YOU NEED TO KNOW TO REGISTER WITH A CUSTOMS AGENT

Drayage or Transfer Fee:

Due to restrictions on Mexican tractors within U.S. territory, a drayage or transfer truck is used to move goods from Mexico into the U.S. Specifically:

- Mexican tractors are limited to a commercial zone extending up to 25 miles from the border (or up to 75 miles in Arizona). Therefore, a drayage or transfer truck must pick up the trailer on the Mexican side of the border and transport it into the U.S. where a U.S. long-haul truck takes over for further delivery.

- Similar rules apply for shipments moving southbound from the U.S. to Mexico.

Shippers pay a drayage fee, also known as a border crossing fee, for this service.

2. Duties and Customs Fees

Once goods arrive at the port of entry in the destination country, customs officials carry out several checks:

- Assess the value of the goods for duty purposes.

- Verify the accuracy of labeling, marking, and invoicing.

- Ensure that the shipment does not contain prohibited items and meets the requirements of other federal agencies.

Goods are only allowed to proceed once customs officials confirm that everything is in order. The customs broker then determines the applicable duties and fees, files the necessary paperwork, and makes any required payments. After customs appraisal, the entry is “liquidated,” meaning the final calculation of duties and/or refunds is complete.

Understanding these fees—customs broker fees, drayage or transfer fees, and duties and taxes—is essential for efficient and compliant cross-border freight transport. By clarifying these costs, we hope to simplify the process and help you navigate international shipping with greater ease.

Source:

https://ops.fhwa.dot.gov/publications/fhwahop12015/ch2.htm#:~:text=The%20typical%20northbound%20border%2Dcrossing,Mexico%20to%20the%20United%20States.

https://www.tradecommissioner.gc.ca/guides/us-export_eu/141461.aspx?lang=eng#cus101

Rodrigue, J-P (ed) (2017), The Geography of Transport Systems, Fourth Edition, New York: Routledge.