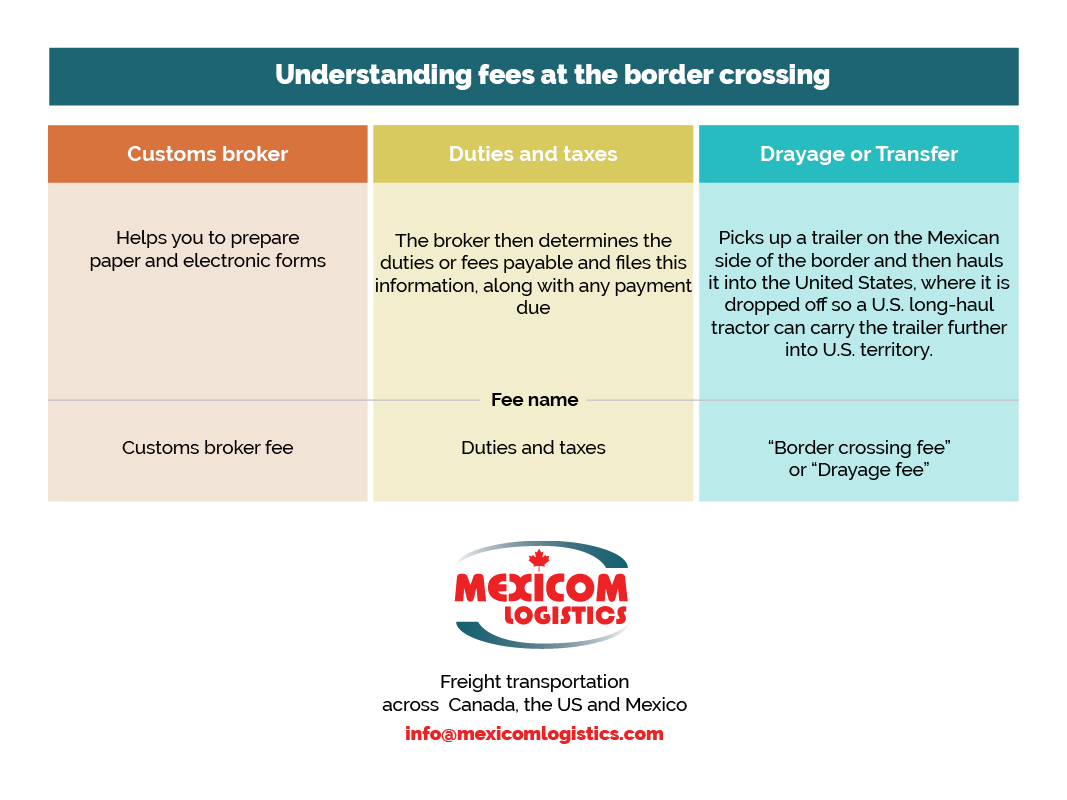

Understanding fees at the border crossing: Drayage or transfer fee, Customs broker fee and duties and taxes

North America is one of the largest trade blocs in the world. Crossing borders across Canada, the U.S. And Mexico remain one of the greatest freight transportation and logistics challenges. This is particularly true for cross-border freight transport through the US-Mexico border. In this post, we will clarify two oftentimes-misunderstood concepts involved in the border crossing freight transportation in North America.

Cross-border freight transport refers to the process, activities, and infrastructures that ensure the passage of commodities and merchandise across an international border.

Customs broker fee vs. Drayage or border crossing transportation fee

The typical border-crossing process requires two steps from the shipper:

- Step 1- To file shipment data with both Mexican and U.S. Federal agencies, prepare both paper and electronic forms.

- Step 2- Use a drayage or transfer tractor to move the goods from Mexico to the United States.

Step 1.

A customs broker can help you to prepare paper and electronic forms. He does this for a fee that is called customs broker fee.

The benefits of using a customs broker include:

- Brokers stay up-to-date with all customs regulations and procedures and will be aware of the latest changes

- They prepare all the export documentation that Mexican Customs and U.S. Customs require.

Step 2

“Mexican tractors are restricted to circulation in a narrow commercial zone extending out to 25 miles from the border – or up to 75 miles in Arizona-. Therefore, Mexican truck shipments into the United States are required to use a drayage or transfer tractor that picks up a trailer on the Mexican side of the border and then hauls it into the United States, where it is dropped off so a U.S. long-haul tractor can carry the trailer further into U.S. territory”. Mexico has similar rules, so the use of a drayage or transfer truck is necessary for both: northbound and southbound shipments.

To be able to use a drayage or transfer truck, shippers have to pay a drayage fee, also called border crossing fee.

Duties and Customs fees

Customs officials will examine goods after they have arrived at the port of entry of the country where they will be imported, to determine:

- the value of the goods for customs and duty purposes;

- the validity of the marking and labelling and the invoice.

- whether the shipment contains any prohibited goods; and if the requirements of other federal agencies have been met.

The goods are allowed to proceed into the destination country only after customs officials have decided that the shipment and its documentation are in order.

The broker then determines the duties or fees payable and files this information, along with any payment due. After official appraisal of the goods, the entry is “liquidated,” meaning that the final computation of duties and/or drawback is complete.

Source:

https://ops.fhwa.dot.gov/publications/fhwahop12015/ch2.htm#:~:text=The%20typical%20northbound%20border%2Dcrossing,Mexico%20to%20the%20United%20States.

https://www.tradecommissioner.gc.ca/guides/us-export_eu/141461.aspx?lang=eng#cus101

Rodrigue, J-P (ed) (2017), The Geography of Transport Systems, Fourth Edition, New York: Routledge.