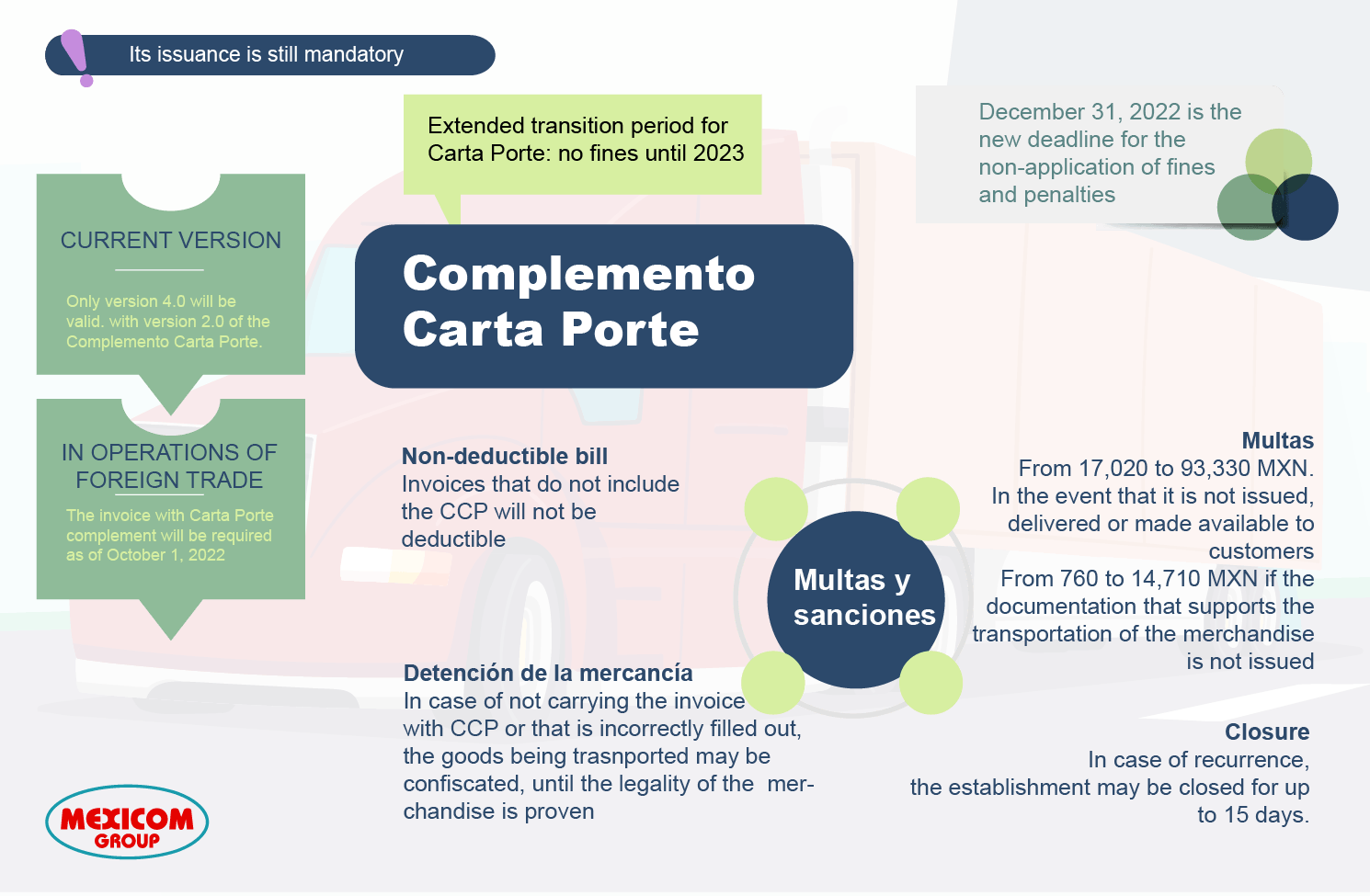

[Infographic] Extended transition period for Carta Porte: no fines until 2023

The Tax Administration Service of Mexico extends the term for the non-application of fines and sanctions in the use of the invoice with the Carta Porte supplement.

December 31, 2022 is the new deadline for the non-application of fines and penalties in the event that the electronic invoice is issued with a bill of lading supplement (Complemento Carta Porte) that doesn’t comply with the applicable requirements. In other words, if the Complemento Carta Porte (Bill of lading supplement) is issued with errors or omissions in 2022, there will be no penalty. However, its issuance is still mandatory.

As of January 1, 2023, only the issuance of the CFDI in version 4.0 will be valid. with version 2.0 of the Complemento Carta Porte.

In foreign trade operations, the invoice with the Complemento Carta Porte will be required as of October 1, 2022.

It is Mandatory

The issuance of the Invoice with a Complemento Carta Porte is mandatory for taxpayers who carry out the transport of goods and merchandise in Mexico. The Complemento Carta Porte, in its version 2.0, is mandatory as of January 1, 2022.

Benefits of issuing the Complemento Carta Porte

The main objective of issuing the Complmento Carta Porte is to prove the legal possession of merchandise during its transportation.

The plugin helps to identify in detail the goods to be certain of which goods are transported. It also accounts for the route through which the goods are transported, to anticipate risks or threats and guarantee their safety. Its implementation is part of the efforts of the Mexican government to decrease informality and smuggling.

Fines and penalties

Non-deductible bills

If an invoice for the goods transport service does not include the Complemento Carta Porte, the invoice won’t be tax deductible.

Detention of merchandise

The federal authorities are empowered to carry out reviews in which it is required to display the invoice with Complemento Carta Porte. In case the Complemento Carta Porte is not shown or it is incorrectly filled out, the items may be confiscated, until the legality of the merchandise is proven.

Fines

Fines can range from 17,020 to 93,330 MXN in the event that the Complemento Carta Porte is not issued, delivered, or made available to clients or in the event that the Complemento Carta Porte does not meet the legal requirements.

Closure

In case of recurrence, the establishment may be closed for up to 15 days.

Sources:

- https://www.eleconomista.com.mx/el-empresario/Cuales-son-los-retos-y-las-multas-del-Complemento-Carta-Porte-20211202-0162.html

- https://www.sat.gob.mx/consultas/68823/complemento-carta-porte-

![[Infographic] Extended transition period for Carta Porte: no fines until 2023 [Infographic] Extended transition period for Carta Porte: no fines until 2023](https://mexicomlogistics.com/wp-content/uploads/bfi_thumb/dummy-transparent-rg1talopm5vqzufhfknfekzf15cxqqaozt80fj4ud4.png)