[Infographic] CANADIAN IMPORTERS, make sure you are prepared for CARM

All Canadian resident and non-resident businesses that import commercial goods into Canada and are ultimately responsible for the payment of any duties and taxes, as the importer of record, will be impacted by CARM, the Canada Border Services Agency (CBSA) initiative.

This post will help you understand the CBSA’s Assessment and Revenue Management project, known as CARM.

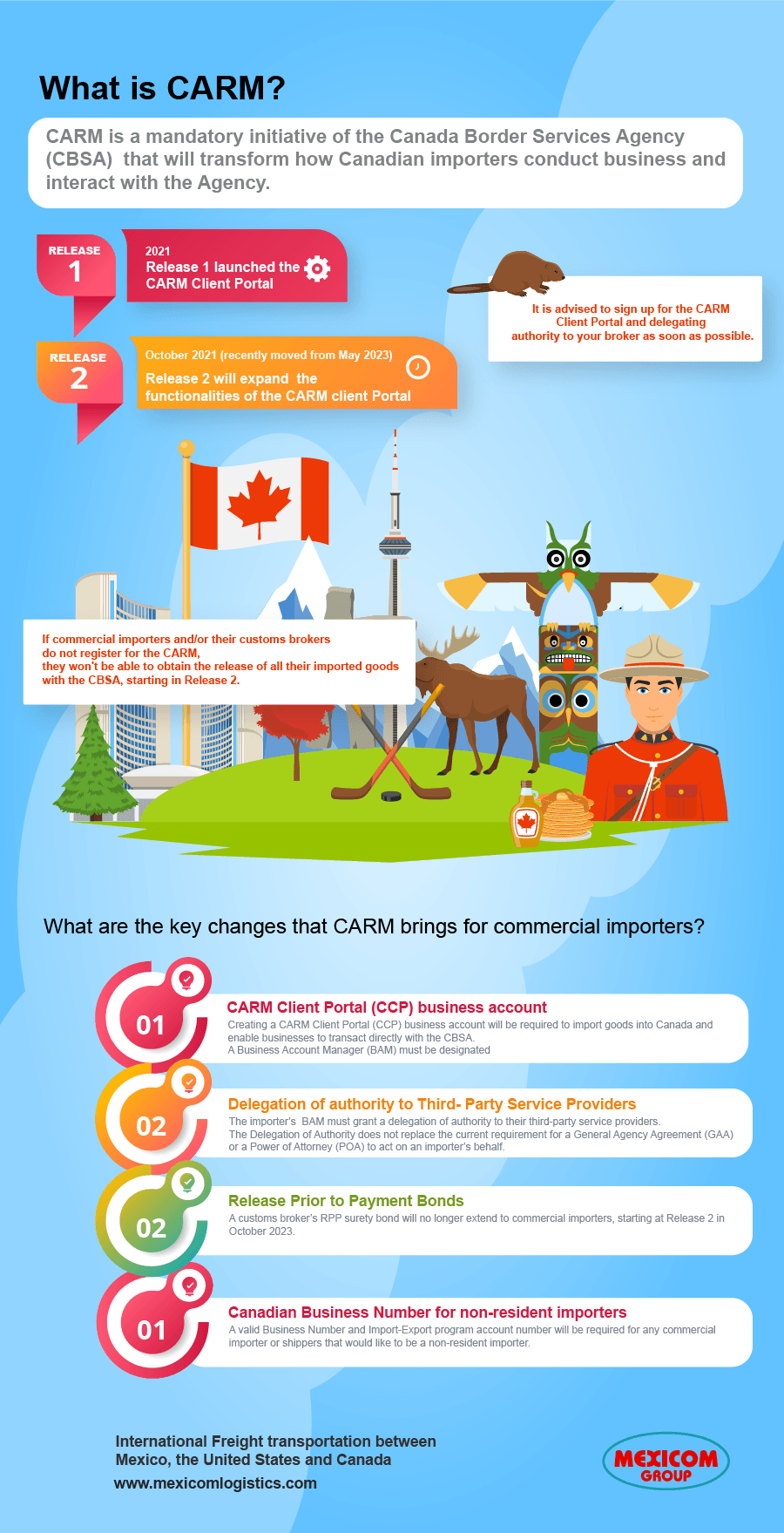

What is CARM?

CARM is a mandatory initiative of the Canada Border Services Agency (CBSA) that will transform how Canadian importers conduct business and interact with the Agency.

CARM is a multi-year initiative. Its implementation consist of two main phases:

Release 1.

In 2021, CARM Release 1 launched the CARM Client Portal, a self-service tool that will facilitate accounting and revenue management processes with the CBSA.

Release 2.

Release 2 will expand the functionalities of the CARM Client Portal. October 2023 (recently moved from May 2023 to October 2023).

It is advised to sign up for the CARM Client Portal and delegate authority to your broker as soon as possible.

What are the key changes that CARM brings for commercial importers?

CARM Client Portal (CCP) business account

Creating a CARM Client Portal (CCP) business account will be required to import goods into Canada and enable businesses to transact directly with CBSA.

- A Business Account Manager (BAM) must be designated by commercial importers to create and manage their CARM Client Portal Business Account.

- Recent transaction information contained in the importer’s Daily Notices (DNs) and monthly Statement of Account (SOA) must be provided by the Business Account Manager.

Delegation of authority to Third- Party Service Providers

The importer’s BAM must grant a delegation of authority to their third-party service providers, for instance, customs brokers, to enable them to manage the importer’s commercial import activities.

The Delegation of Authority does not replace the current requirement for a General Agency Agreement (GAA) or a Power of Attorney (POA) to act on an importer’s behalf.

Release Prior to Payment Bonds

A customs broker’s RPP surety bond will no longer extend to commercial importers, starting at Release 2 on October 2023.

In order to release and account for all their imported goods with the CBSA, commercial importers will need to post their own financial security. For Instance: a surety bond or cash deposit.

Canadian Business Number for non-resident importers

A valid Business Number and Import-Export program account number will be required for any commercial importer or shipper that would like to be a non-resident importer.

Here, you can find more information about how to register for business numbers or Canada Revenue Agency program accounts.

Why is it important to register fo the CARM?

If commercial importers and/or their customs brokers do not register for the CARM, they won’t be able to obtain the release of all their imported goods with the CBSA, starting in Release 2.

Who does the CARM impact?

All Canada Border Services Agency trade chain partners are impacted by CARM:

- Commercial Importers

- Foreign producers/exporters

- Carriers

- Customs Brokers

- Trade Consultants

- Surety Companies

- Industry professionals

Takeaways:

- The CARM Client Portal (CCP) was launched on May 25, 2021, but commercial importers are not mandated to register until Release 2 when all interactions with the CBSA will be done through the CCP.

- Commercial Importers are encouraged to register and provide their broker(s) with their Delegation of Authority before Release 2, to avoid shipment delays.

- The CBSA has announced that Release 2 was recently moved from May 2023 to October 2023

Register for a Webinar

-

In English: CARM onboarding Webinar

- Tuesday, December 13th, 2022 1:00 p.m. – 2:30 p.m. ET

- Register here

-

In French: Webinaire sur la connexion au Portail client de la GCRA

- Tuesday, December 13th, 2022 3:00 p.m. – 4:30 p.m. ET

- Register here

Useful resources:

Instructional videos from the CBSA:

How to create sign in credentials and a user account in the CARM Client Portal

How to link a user account to a business account in the CARM Client Portal

How to set up a delegation of authority for employees in the CARM Client Portal

How to set up a delegation of authority for a third party service provider in the CARM Client Portal

How to manage a client group in the CARM Client Portal

How to upload a document to the CARM Client Portal

How to submit a ruling request in the CARM Client Portal

How to request a modification to a submitted ruling in the CARM Client Portal.

Other Instructional videos on CARM, here

Sources & Credits

https://www.cbsa-asfc.gc.ca/media/video-eng.html#_a4

<a href=”https://www.freepik.com/free-vector/canadian-national-symbols-composition-flat-poster_3797902.htm#query=Canada&position=1&from_view=search&track=sph”>Image by macrovector</a> on Freepik

![[Infographic] CANADIAN IMPORTERS, make sure you are prepared for CARM [Infographic] CANADIAN IMPORTERS, make sure you are prepared for CARM](https://mexicomlogistics.com/wp-content/uploads/bfi_thumb/dummy-transparent-rg1talopm5vqzufhfknfekzf15cxqqaozt80fj4ud4.png)

This is the very first time I frequented

your web page and so far? I surprised with the analysis you made to make this actual publish amazing.

Magnificent job!