Freight Shipping Industry Forecast 2023

For shippers of international cargo between Mexico, the United States, and Canada, it is important to consider the evolution and forecast of Freight Transportation rates in 2023, since some carriers are already negotiating freight contracts that extend for two or three years.

In the market cycle of freight shipping, the freight market is balanced and has been in oversupply for several months and will increase in the short term. For 2023, the recommendation for shippers is to prepare the strategy for moving towards the next phase of the market cycle, developing the upcycle.

Most carriers are confident that in 2023 their schedule and rates will return to pre-pandemic levels. However, in the past two years, shippers have also learned that many companies are capable of paying thousands of dollars more than they were before 2020. Big players in supply chains, and fleet owners, like Walmart, Home Depot, Target, etc, demonstrate spectacular business results since 2021 despite the problems that arose in the supply chain. These companies account for a large proportion of the carriers’ capacity, so they have little motivation to lower rates below the levels they pay.

During the pandemic, and especially in the last year, the rapid emergence of new, smaller carriers entering the freight forwarding services market has continued. However, now that we are getting back to normal and rates are starting to drop, it is likely that many of the newcomers will become unprofitable and leave the market. The same thing happened in 2010, after the 2008 crisis when the freight market rebounded, but all these services disappeared when the growing trend ended.

On the other hand, owner-operators are faced with tight spot prices, high prices in fuel, and a low number of loads on the spot market.

What has been the recent evolution of freight rates?

The average rate in the United States to move spot dry and refrigerated freight fell for the seventh consecutive month in August.

The spot dry Van rate fell 11 cents to $2.52 per mile for the month, while the reefer rate fell 10 cents to $2.89 per mile. The average spot rate for flatbeds also plunged (24 cents to $3.05 per mile in August) and was 40 cents below the all-time high set in March, DAT reported.

“The sharp pullback in spot prices is what has people so concerned about, and if you look at the implicit long-haul rates, the decline is even steeper because this total rate is supported by higher fuel prices.” , explained Jason Miller, associate professor of supply chain management at Michigan State University’s Eli Broad College of Business.

Miller predicts that the Russia-Ukraine war will spur more energy production in the US, and that the US energy sector will benefit in the long run as Europe moves away from oil production from From Russia.

Another crucial point is that the railway workers have not yet concluded their contractual negotiations, for a contract that expired in 2020. The proposal of the Presidential Emergency Board is the 22% increase gradually over five years. But this would not only impact the railway sector, but the increase will be reflected in higher intermodal rates and this is where a large amount of LTL cargo moves.

We have already seen that the LTL service has increased its operating costs over the last few years: rising costs of operators, the high price of fuel, and the increase in insurance have been the main factors of the increase in costs.

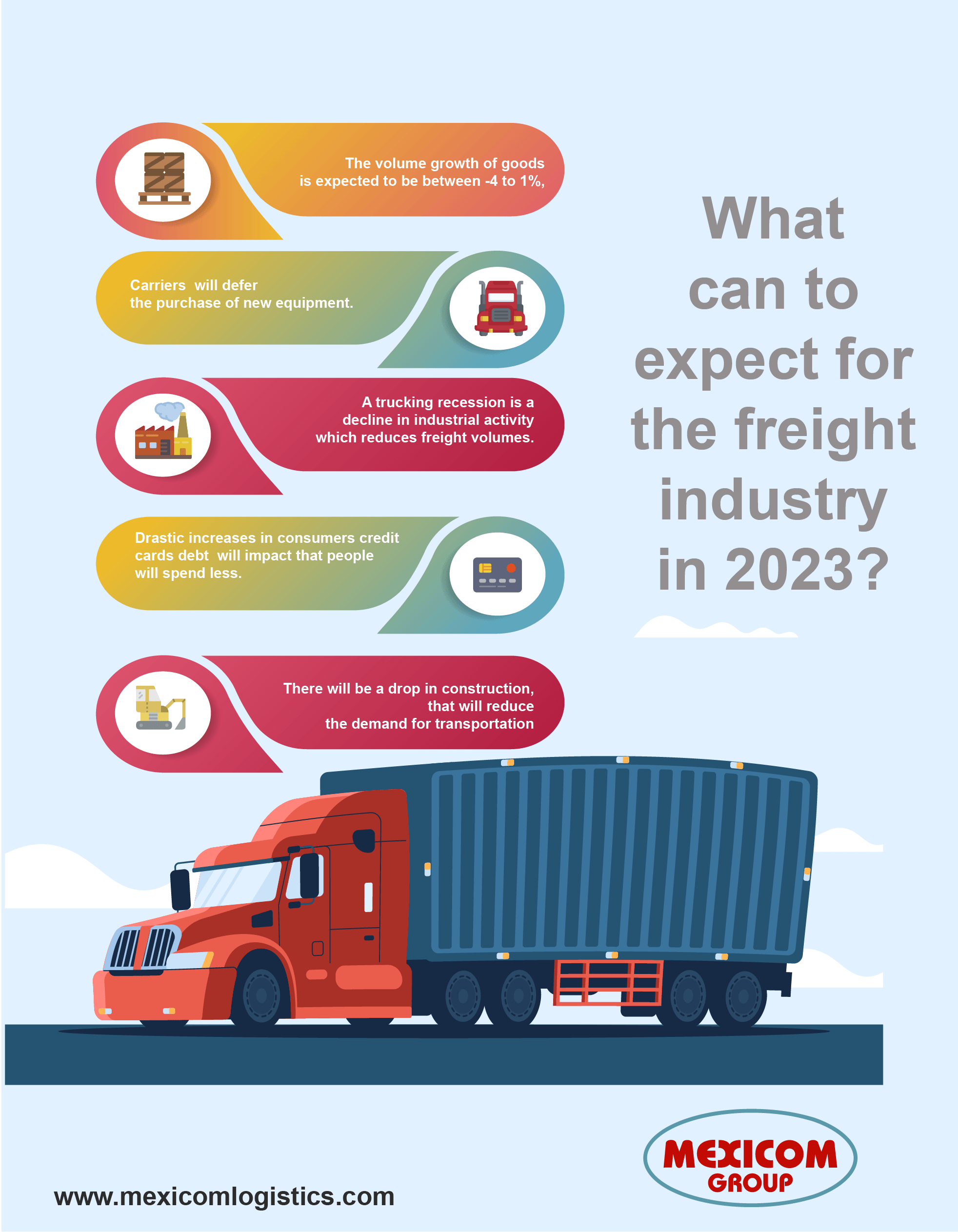

What do we expect for Freight shipping in 2023?

- The growth of the volume of goods is between -4 to 1%, there will continue to be an excess supply of freight transport services.

- Consequently, carriers will take stock of the market and postpone the purchase of new equipment.

- A trucking recession is a decline in industrial activity that reduces freight volumes.

- Drastic increases in consumer credit card debt will impact people spending less.

- There will be a drop in construction, which will reduce the demand for transportation, because the demand for transportation, especially for flatbeds, depends on the real estate market for the transportation of construction materials.

Sources and credits:

In collaboration with Yohany Soriano

https://www.chrobinson.com/es-mx/resources/insights-and-advisories/north-america-freight-insights/https://blog.tranzact.com/2-minute-warning/what-to-consider-when-building-a-2023-freight-budgethttps://www.morethanshipping.com/2023-and-beyond-what-to-expect-for-shipping-rates-and-deliverability/https://www.fleetowner.com/news/economics/article/21252390/analyst-takes-neutral-stance-on-likelihood-of-2023-trucking-recession