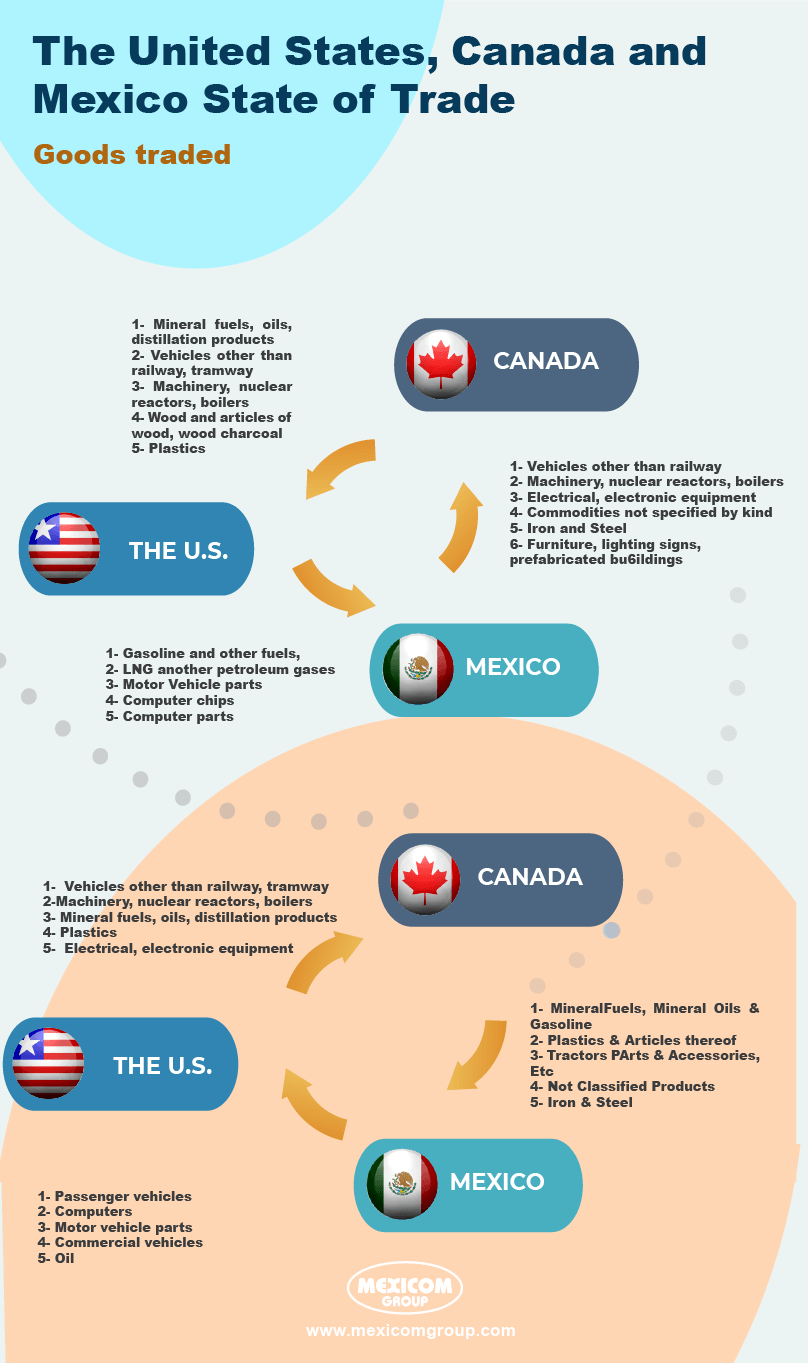

[Infographic] The United States, Canada and Mexico State of Trade

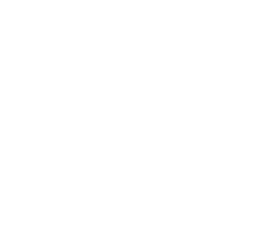

Canada, the United States, and Mexico form one of the world’s largest and most competitive economic regions. Last month marked the second anniversary of their trade agreement, the United States-Mexico-Canada Agreement (USMCA), also known as the new NAFTA.

During its years of existence, from 1994 to 2000, NAFTA boosted trade and helped integrate supply chains in North America. Then USMCA entered into force in 2020, a year when the trade flows decreased significantly due to the COVID-19 pandemic.

In the post-pandemic period, the Mexico, U.S., and Canada trade bloc is experiencing a new boost and the relationship between the three countries continues to be strong. The total value of merchandise trade between Canada, the United States, and Mexico reached nearly $1.5 trillion in 2021. In the last North American Leaders’ Summit, in 2021, leaders of the 3 north American countries agreed to work together to strengthen supply chains and increase trade opportunities.

The North America Trade Bloc in Numbers

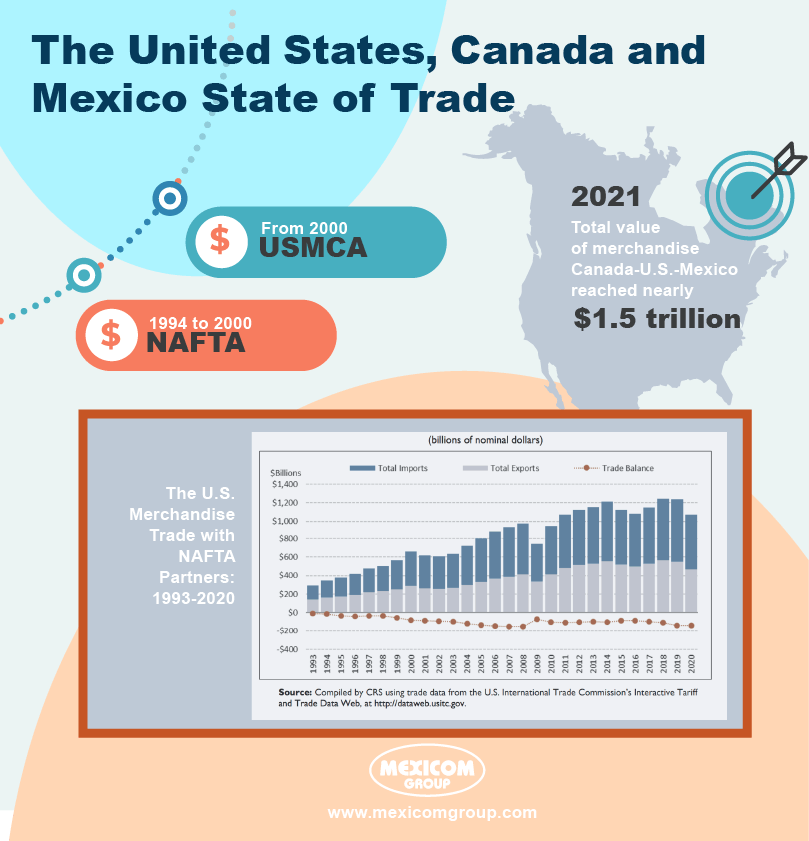

The trade with Canada and Mexico represented 28% of the U.S.’s merchandise total trade in 2021.

In the recent months, the U.S.’s trade with Canada and Mexico together increased from 28% to 30%, whereas the trade between the U.S. and China went down to 13%. In june 2022, the U.S. total trade with Canada and Mexico increased 24.75% and 18.78% respectively, compared with the same month one year ago.

The trade relationship between the three countries has been strong for decades. In 2000, nearly one-third of U.S. merchandise trade was with Canada and Mexico, a slight increase from 29 percent in 1994.

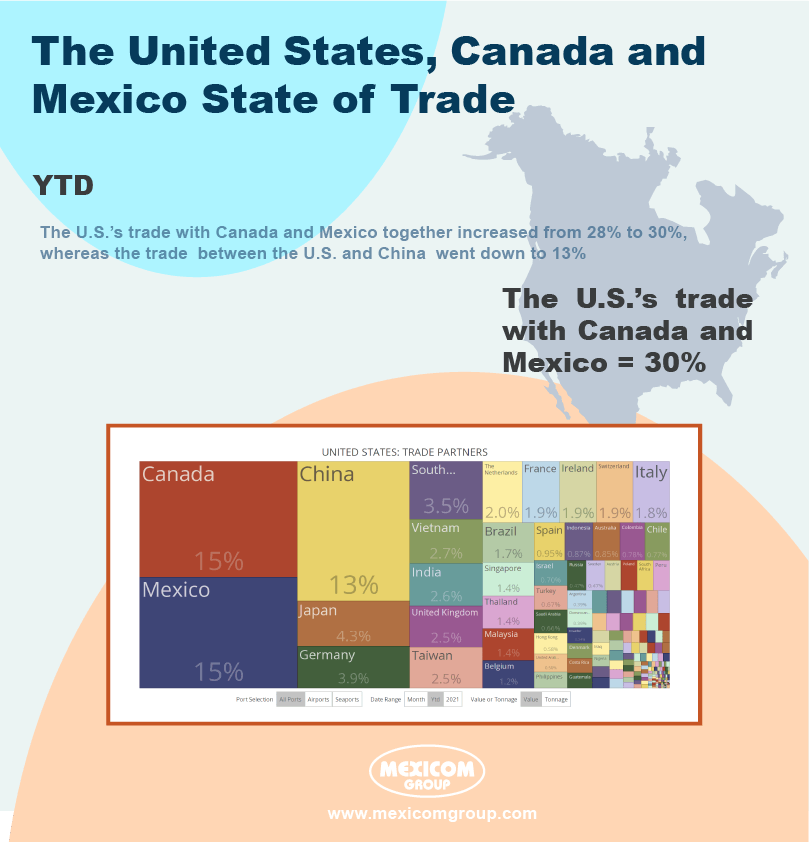

Through the current period, Canada ranked No. 1 and Mexico No. 2 among the United States’ top trade partners through the current period. In the same period one year ago, Mexico ranked No. 1.

Canada and the U.S. share one of the largest trading relationships in the world, the total value of trade in goods and services between the two countries exceeded $1 trillion in 2021.

The U.S.-Canada/Canada-U.S. Supply Chain Working Group focuses on enhancing cooperation in key areas such as:

- Electric Vehicles and Batteries

- Critical Minerals

- Public Health, Critical Medicines, Medical Devices and Personal Protective Equipment (PPE)

- Defense/Defence

- Information and Communications Technologies, including Semiconductors

- Solar

- Transportation and Logistics

- Regulatory Cooperation

Canadian trade and investment with Mexico is steadily growing. The total value of trade in goods and services between Canada and Mexico reached $31.8 billion in 2021.

Mexico is Canada’s third largest single-country merchandise trading partner, after the U.S. and China. While Canada was Mexico’s sixth-largest merchandise trading partner in 2021.

Export Development Canada has identified Mexico as a priority market thanks to its stability, growing consumer class, and competitive labor.

Canada identifies trade opportunities with Mexico in the following sectors:

- Aerospace

- Agriculture and processed food

- Automotive

- Clean-tech

- Creative industries

- Education

Mexico’s most important trading partner is the United States (78% of total exports), followed by Canada and China.

What is traded between Mexico, the U.S., and Canada?

The U. S. exports to Mexico

1- Gasoline and other fuels,

2- LNG another petroleum gases

3- Motor Vehicle parts

4- Computer chips

5- Computer parts

The U.S. imports from Mexico

1- Passenger vehicles

2- Computers

3- Motor vehicle parts

4- Commercial vehicles

5- Oil

Canada imports from the U.S.

1- Vehicles other than railway, tramway

2-Machinery, nuclear reactors, boilers

3- Mineral fuels, oils, distillation products

4- Plastics

5- Electrical, electronic equipment

Canada exports to the U.S.

1- Mineral fuels, oils, distillation products

2- Vehicles other than railway, tramway

3- Machinery, nuclear reactors, boilers

4- Wood and articles of wood, wood charcoal

5- Plastics

Mexico imports from Canada

1- Mineral Fuels, Mineral Oils & Gasoline

2- Plastics & Articles thereof

3- Tractors Parts & Accessories, Etc

4- Not Classified Products

5- Iron & Steel

Mexico Exports to Canada

1- Vehicles other than railway, tramway

2- Machinery, nuclear reactors, boilers

3- Electrical, and electronic equipment

4- Commodities not specified according to kind

5- Iron and Steel

6- Furniture, lighting signs, prefabricated buildings

Sources:

- https://www.canada.ca/en/global-affairs/news/2022/07/minister-ng-concludes-successful-trilateral-meeting-of-canada-united-states-mexico-agreement-free-trade-commission.html

- https://www.bts.gov/archive/publications/north_american_trade_and_travel_trends/trade_can_mex

- https://www.international.gc.ca/country-pays/us-eu/relations.aspx?lang=eng#a2

- https://www.international.gc.ca/transparency-transparence/supply_chains_progress_report-rapport_etape_chaine_approvisionnement.aspx?lang=eng

- https://www.international.gc.ca/country-pays/mexico-mexique/relations.aspx?lang=eng

- https://tradingeconomics.com/united-states/imports/canada

- https://tradingeconomics.com/mexico/exports/canada

![[Infographic] The United States, Canada and Mexico State of Trade [Infographic] The United States, Canada and Mexico State of Trade](https://mexicomlogistics.com/wp-content/uploads/bfi_thumb/dummy-transparent-rg1talopm5vqzufhfknfekzf15cxqqaozt80fj4ud4.png)