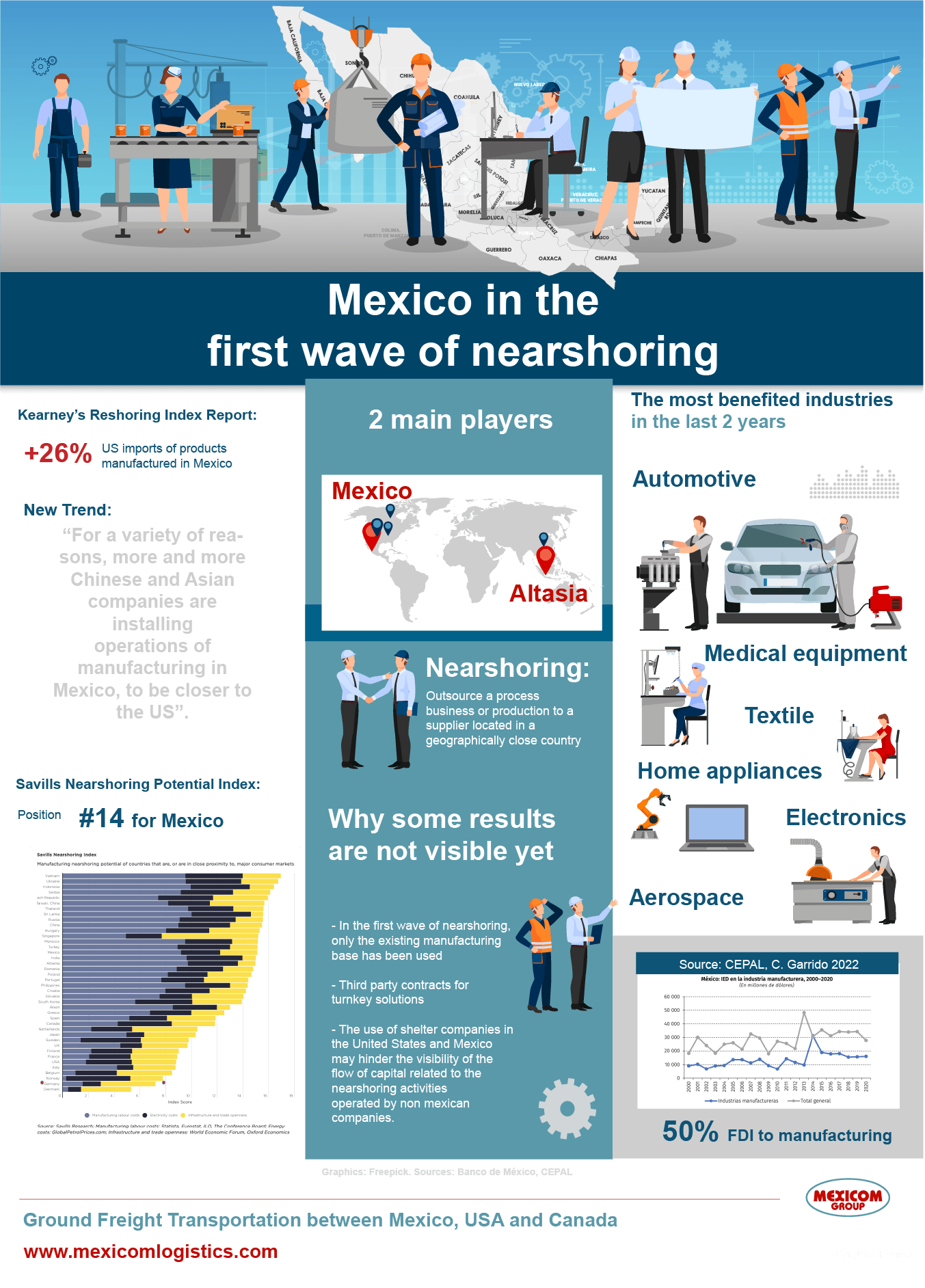

The position of Mexico in the first wave of Nearshoring

The term nearshoring has positioned itself in the collective imagination of professionals dedicated to supply chains who are continually facing all the challenges that post-COVID continues to present to us. Much has been said about the privileged position that Mexico has in conection to the nearshoring and the opportunities it represents. Today we can talk about the fact that we are in the first wave of Nearshoring, and its results are becoming increasingly visible and quantifiable.

In this post, we start by providing a definition of the term nearshoring; as well as the meaning of the strategies adjacent to it, reshoring and offshoring. Subsequently, we fully delve into the position that Mexico has had in this first wave. We will see its potential, we will analyze its place in the Kearney and Savills nearshoring indices, we will see how nearshoring affects Mexico, the results of the first wave and the current trend. Finally, we show what are the industries that benefited the most in the last two years

Difference Between Nearshoring, Reshoring, and Offshoring

In easy terms, from Chat GPT, nearshoring, reshoring and offshoring are terms that are used in the business field to refer to the geographical location of suppliers or production processes. The differences between them are described below:

- Nearshoring: refers to the process of outsourcing a business or production process to a provider located in a geographically close country. For example, a company based in the United States could outsource its production to a supplier in Mexico or Canada. The advantage of nearshoring is that the company can take advantage of geographic proximity, cultural and linguistic similarity to maintain greater control and better communication with the supplier.

- Reshoring: refers to the process of bringing production or business processes back to the parent company, after having previously been outsourced to a provider abroad. This process is generally carried out to improve product quality, reduce costs, and strengthen the supply chain.

- Offshoring: Refers to the process of outsourcing a business or production process to a provider located in a foreign country, generally with lower labor costs. For example, a company based in the United States could outsource its production to a supplier in China or India. The advantage of offshoring is that the company can take advantage of lower labor costs, but may face challenges related to time difference, communication, and product quality.

Altasia and Mexico lead Nearshoring

Post-COVID, companies realized the vulnerability and risks of global sourcing strategies that involve long distances. Therefore, the current trend has been to apply the nearshoring strategy. Globally, there are two major regions where nearshoring is observed: “Altasia” and Mexico. The first refers to the Asian nations that are replacing China as the center of supply chains. It refers to nations where costs are lower, such as Vietnam, Bangladesh, the Philippines, among others.

For its part, Mexico has positioned itself in a leading role in nearshoring, as a preferred link in supply chains not only in North America, by increasing its growth as the main player in imports to the United States, but also as a country that it attracts investment from China, who want to be close to the American market.

“But what if that ecosystem of suppliers that China and other Asian countries have been building for the past three decades were to move closer to the US? That’s exactly what we’re starting to see happening in this year’s edition of the Kearney Reshoring Index because, for a variety of reasons, more and more Chinese and Asian companies are setting up manufacturing operations in Mexico.” – Kearney

What determines the competitiveness of a country in nearshoring?

Kearney is a company that has been observing and reporting trends in reshoring and nearshoring for 10 years. The company has an indicator that makes cross-assessments regarding the conditions for nearshoring in two countries in relation to another reference country.

“This index measures, for example, in the case of Mexico, the relationship between the value of manufacturing exports made by Mexico in relation to the equivalent exports of a low-cost Asian country. As an example, this translates into the relationship between each dollar imported by the United States from an Asian country and what it represents with respect to the equivalent of imports from Mexico, which has been in the order of 38 cents on the dollar, but that in recent years has tended to rise to 42 cents on the dollar. In other words, there has been a relative increase in manufacturing exports from Mexico to the United States.” – C. Garrido, ECLAC

The potential of Mexico in Nearshoring

In his 2022 report, Kearney highlights the role that Mexico has obtained in nearshoring, having a large part of the United States import manufacturing market. They point out, for example, one of the indicators of the growth of nearshoring: since COVID, American imports of manufactured products have grown 26 percent, from 320 billion to 402 billion. In this way, Mexico’s market share has increased significantly, compared to other countries that import to the United States.

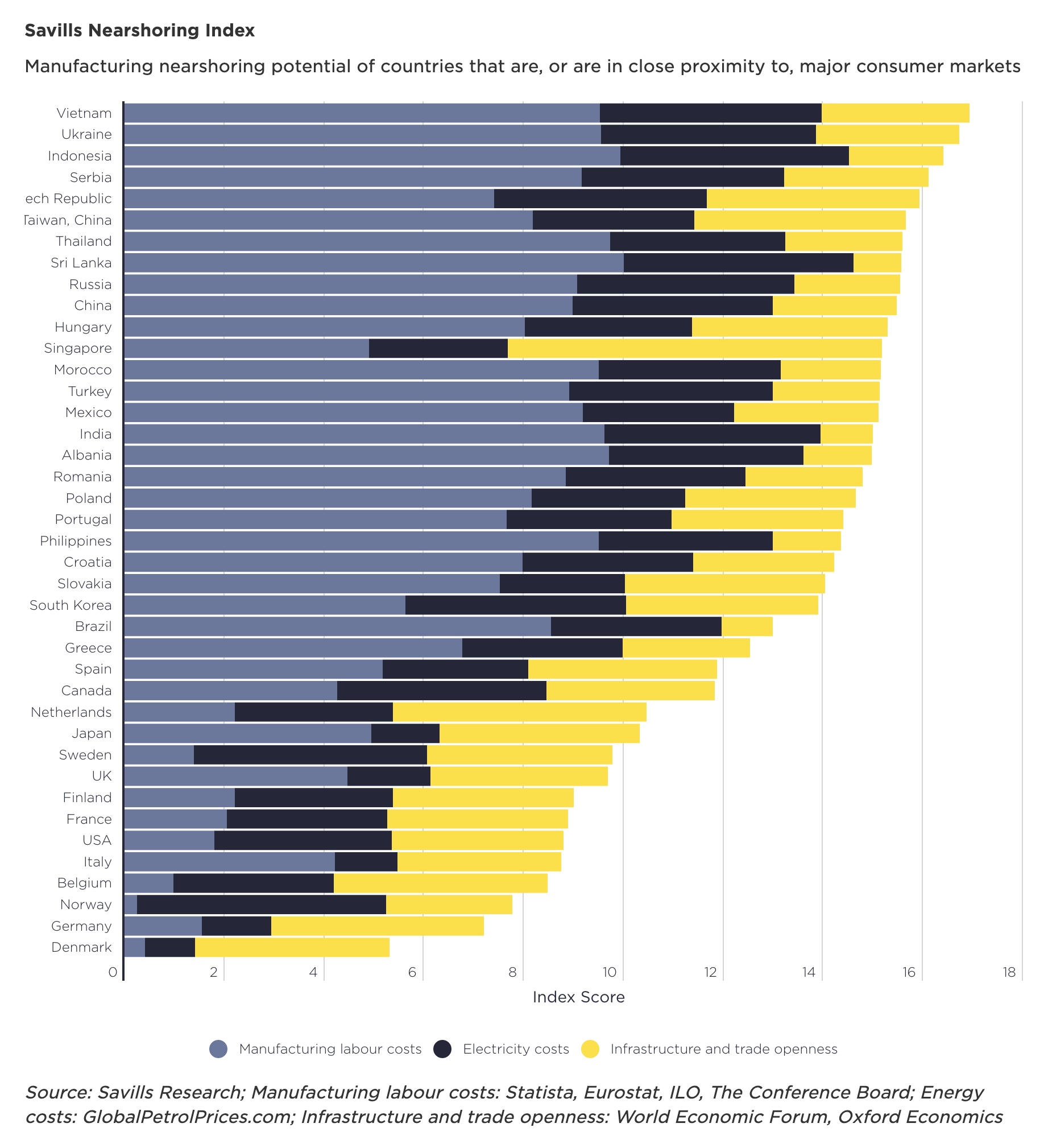

Mexico stands out on the Savills list for its attractive manufacturing and commercial environment

Savills, a UK property advisory company, creates a list using the nearshoring potential indices of nations that are close to major consumer markets. This list is regularly updated and the latest version was published in 2020. In it, Mexico occupies the 15th position, in a universe of 40 countries.

The index establishes its classification not only based on the cost of labor or the geographical proximity of the countries, because as the real estate company establishes: “For manufacturers, labor is not the only critical cost.” Factors such as energy costs, quality infrastructure, a favorable business and regulatory environment, and some existing manufacturing export base are key elements in making a country a favorable candidate for nearshoring.

Nearshoring in Mexico: opportunity for Chinese manufacturing to serve the American market

Another interesting phenomenon is that Chinese manufacturing companies have emerged in Mexico as a strategy to build and expand their capabilities closer to the American market. In this way, Chinese companies have begun to move their manufacturing to Mexico to better serve the needs of their customers in the United States and to take advantage of the good terms of diplomatic relations between the United States and Mexico, and thus immunize themselves from the tensions in the existing geopolitical relations between China and the United States.

How does nearshoring affect Mexico?

Nearshoring has had a positive impact on the Mexican economy, as it has attracted foreign investment and has generated employment in the manufacturing sector.

Analysis of foreign investment in Mexico

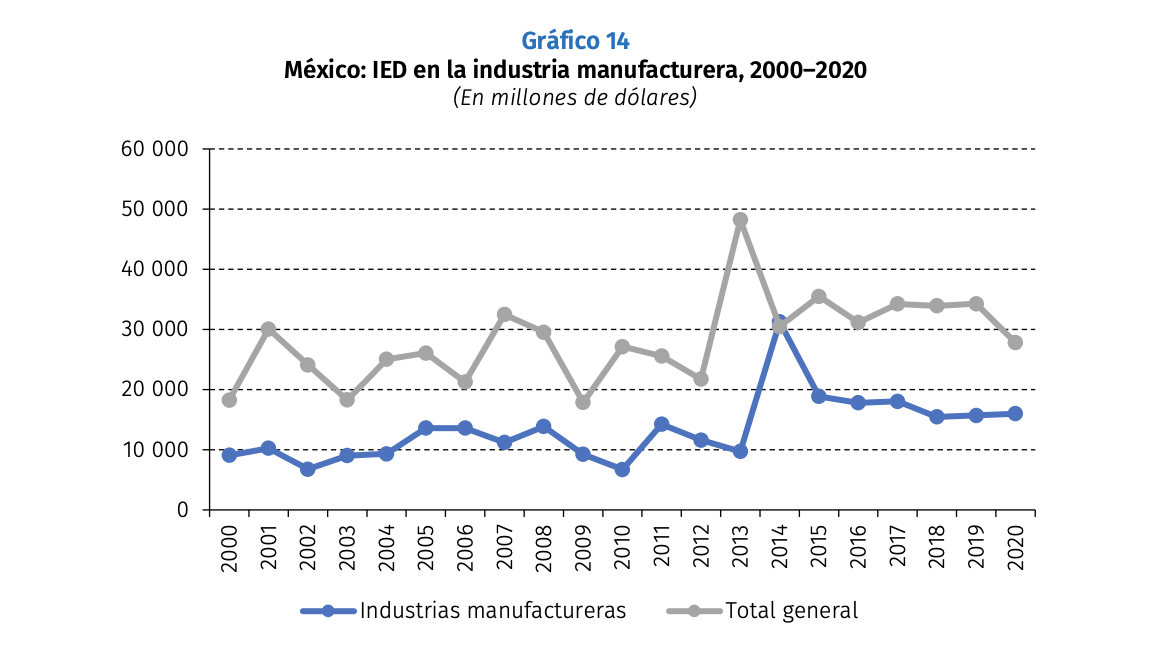

Manufactures represent almost 50% of the total FDI received by Mexico in the last two decades.

“The information on foreign investment in the manufacturing industry suggests that the structural effect of Mexico’s strategic coupling with the United States economy is fully maintained and with it the determining role of the neighbor factor in the relationship.” – C. Garrido, 2022

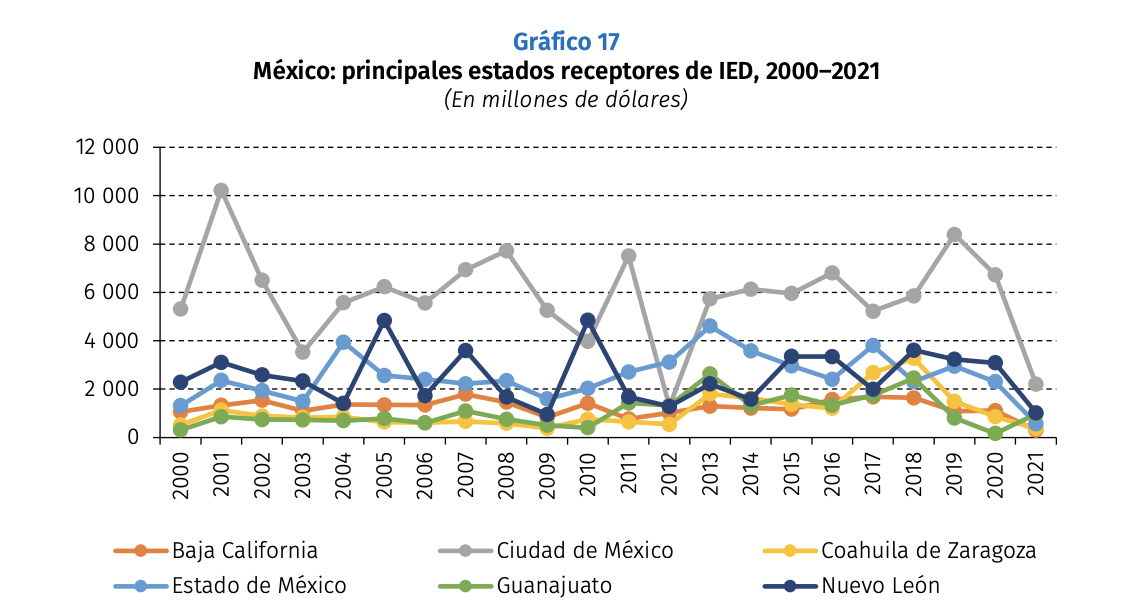

Factors that determine which states receive the most foreign investment:

- Market size, as in the case of Mexico City and the State of Mexico

- Location of corporate headquarters of foreign companies, as is the case of CDMX

- Proximity to the United States, as in the case of Nuevo León, Baja California and Guanajuato

The proximity to the United States establishes “particular facilities for access to supplies from the United States and for the rapid access of products to the United States market, which underlines the two-way nature of the neighborhood factor for production and for export”. ” – C. Garrido, 2022

What are the industries that have benefited the most from nearshoring in Mexico?

The automotive, home appliances, medical devices, and electronics industries are closely related to the nearshoring phenomenon in Mexico, as these industries have historically been the most benefited from outsourcing production processes and business services to geographically close providers.

Automotive Industry: In the case of the automotive industry, Mexico has become an important vehicle production center for international companies such as General Motors, Ford, Nissan and Volkswagen, among others. The country is an attractive destination for the outsourcing of automobile and automotive component production, engineering services, design, and other business services to Mexican suppliers.

Appliances: Mexico has also experienced an increase in the production and outsourcing of the manufacture of products such as washing machines, dryers, refrigerators and air conditioners. Companies such as Whirlpool, LG and Samsung have established factories in Mexico to produce products for the US and Latin American markets.

Medical equipment: The trend in the production of medical equipment in the country continues to rise. Companies like Medtronic, Stryker and GE Healthcare have invested in building factories and acquiring local companies to produce medical devices in the country.

Electronics: Finally, in the electronics industry, electronic products such as televisions, mobile phones and computers are produced in Mexico. Companies like Samsung, Sony, Intel and HP have established factories in Mexico.

Aerospace: Mexico is becoming an important aerospace supplier, thanks to its skilled labor and the fact that it has important aerospace parks.

Why are the results of nearshoring in Mexico not fully visible?

According to the Kearney report, despite Mexico’s growing success in nearshoring, it is important to note that the increase in exports to the United States is not fully reflected in the results of foreign direct investment in Mexico. The reason for this is that we are only seeing the first wave of nearshoring where the existing manufacturing base has been used primarily through third party contracts for turnkey solutions.

In addition, a shift in the trend towards host companies is being observed in the United States and Mexico, which may be absorbing a portion of the capital related to nearshoring operations from non-Mexican companies.

Although Mexico’s foreign direct investment figures do not fully reflect the success of nearshoring in the country, this should not detract from the fact that Mexico remains a very attractive destination for companies seeking to improve the efficiency of their supply chains and increase their international competitiveness. Additionally, as US companies continue to recognize the advantages of nearshoring in Mexico, we are likely to see an increase in foreign direct investment and further growth in the future.

Sources:

https://www.savills.com/impacts/market-trends/global_manufacturing_supply_chains_the_future.html}

https://www.kearney.com/operations-performance-transformation/us-reshoring-index

Chat GPT

https://repositorio.cepal.org/bitstream/handle/11362/48056/4/S2200726_es.pdf

Absolutely loved this piece on SEO strategies!

It’s clear, concise, and packed with actionable tips.

Thanks for sharing your expertise!