Mexico e-Invoicing: Starting April 1, 2023, only CFDI v4.0 with Carta Porte v2.0 will be valid.

Starting April 1, 2023, only CFDI v4.0 with Carta Porte v2.0 will be valid. This change is mandatory for all taxpayers in Mexico who transport goods and merchandise within the Mexican Territory. This means that any other version of the CFDI or Carta Porte will not be accepted by the tax authorities.

The CFDI, or Comprobante Fiscal Digital por Internet, is an electronic invoice used in Mexico to document transactions between businesses. It is required by law for all businesses to issue CFDIs for sales made within the country.

Version 4.0 of the CFDI includes new adjustments and validations to be carried out by the certification provider for the issuance of the Carta Porte complement.

The Carta Porte Complement is an additional document that must be included with the CFDI for transport services provided within Mexico.

The Carta Porte v2.0 became effective on December 1, 2021, and it became mandatory starting on January 1, 2022. This means that all taxpayers who transport goods and merchandise within Mexico must use Carta Porte v2.0 from this date forward.

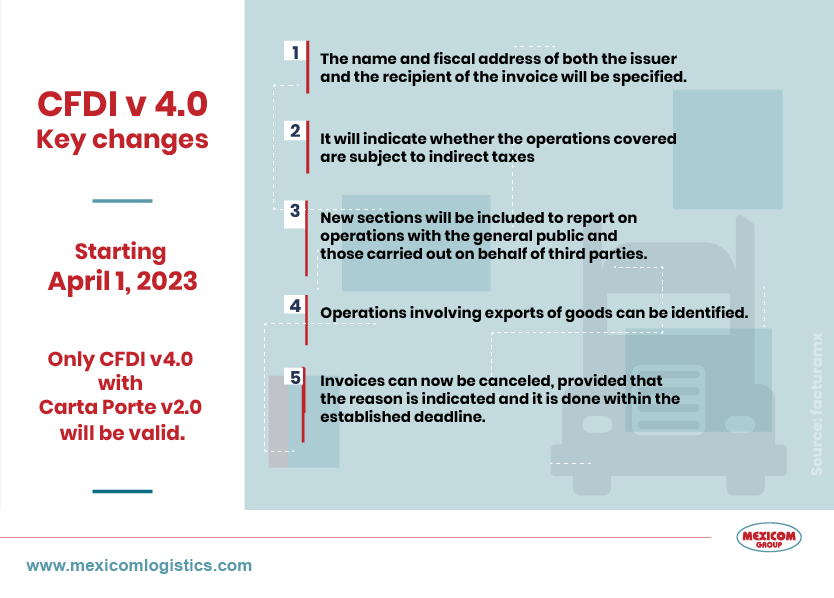

What are the major changes in the CFDI v4.0?

According to facturamx, the major changes are:

- The name and fiscal address of both the issuer and the recipient of the invoice will be specified.

- It will indicate whether the operations covered are subject to indirect taxes.

- New sections will be included to report on operations with the general public and those carried out on behalf of third parties.

- Operations involving exports of goods can be identified.

- Invoices can now be canceled, provided that the reason is indicated and it is done within the established deadline.

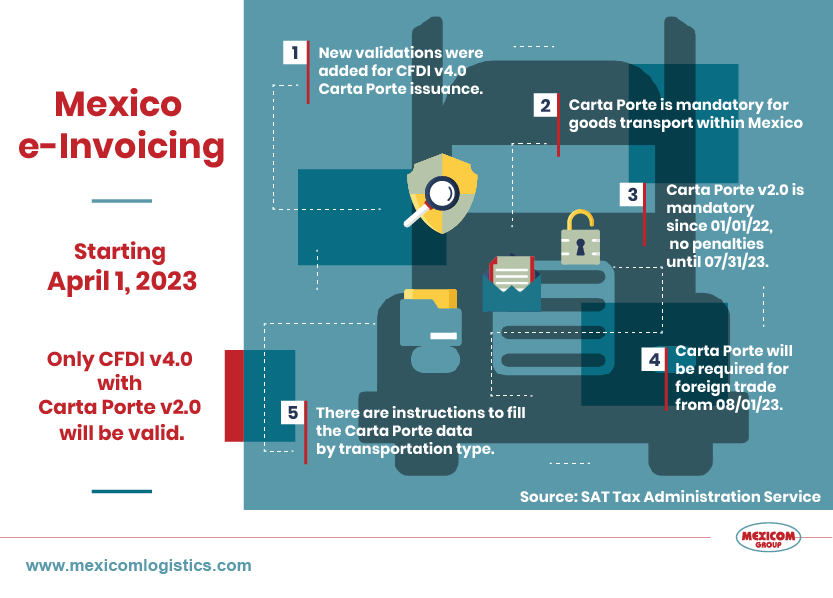

Key information and dates provided by the Tax Administration Service (SAT) in Mexico:

- New validations were added for CFDI v4.0 Carta Porte issuance.

- Carta Porte is mandatory for goods transport within Mexico.

- Carta Porte v2.0 is mandatory since 01/01/22, no penalties until 07/31/23.

- There are instructions to fill the Carta Porte data by transportation type.

- Only federal authorities can request to display the CFDI with Complemento Carta Porte.

- Carta Porte will be required for foreign trade from 08/01/23.

For more information, please refer to the page of the Tax Administration Service (SAT) in Mexico, by clicking here. The SAT is responsible for collecting taxes and ensuring compliance with tax laws in Mexico.

For further information and resources on Carta Porte and its correct filling, we recommend checking out the following links:

I am extremely inspired together with your writing talents and also

with the structure on your blog.

Very good article. I absolutely appreciate this site. Keep

it up!