How COVID-19 is disrupting supply chains in North America-What manufacturers are saying? – Part 1

The Impact of the COVID-19 Outbreak on Manufacturing Companies in North America

North American companies remain heavily reliant on Canada-US-Mexico supply chains, which have been highly disrupted during the first 2020 quarter – and continue to be seriously affected- amidst the COVID-19 Pandemic.

Efforts have been made by the Governments of the three North American Countries to have a trilateral exchange that contributes to internal reflection processes. Part of the ongoing dialogue during COVID-19 pandemic is related public policies, including sanitary measures, the maintenance of air routes and land transport for the flow of people and essential goods, development and access to vaccines and treatments, long-term continuity of value chains, and strengthening North American competitiveness and prosperity.

However, as the Congressional Research Service of United States mentions in its report about Global Economic Effects of COVID-19, “The pandemic crisis is challenging governments to implement monetary and fiscal policies that support credit markets and sustain economic activity. In doing so, however, these policy approaches are displaying differences between countries that promote nationalism versus those that argue for a coordinated international response”.

Manufacturing sectors in North America particularly affected due to its integration for the use of cross-border inputs/outputs.

The auto, defence-aerospace, energy and electronic sectors are particularly affected due to its integration for the use of cross-border inputs/outputs. Those who fabricate intermediary products need their inputs to be able to service OEMs.

Trade will likely fall steeper in sectors with complex value chains, particularly electronics and automotive products, said unsurprisingly a report from the WTO released in April: “According to the OECD Trade In Value Added (TiVa) database, the share of foreign value-added in electronics exports was around 10% for the United States, 25% for China, more than 30% for Korea, greater than 40% for Singapore and more than 50% for Mexico, Malaysia and Vietnam. Imports of key production inputs are likely to be interrupted by social distancing, which caused factories to temporarily close in China and which is now happening in Europe and North America.”

A survey conducted by the National Association of Manufacturers of its member companies on the impact of the COVID-19 outbreak to manufacturers revealed that

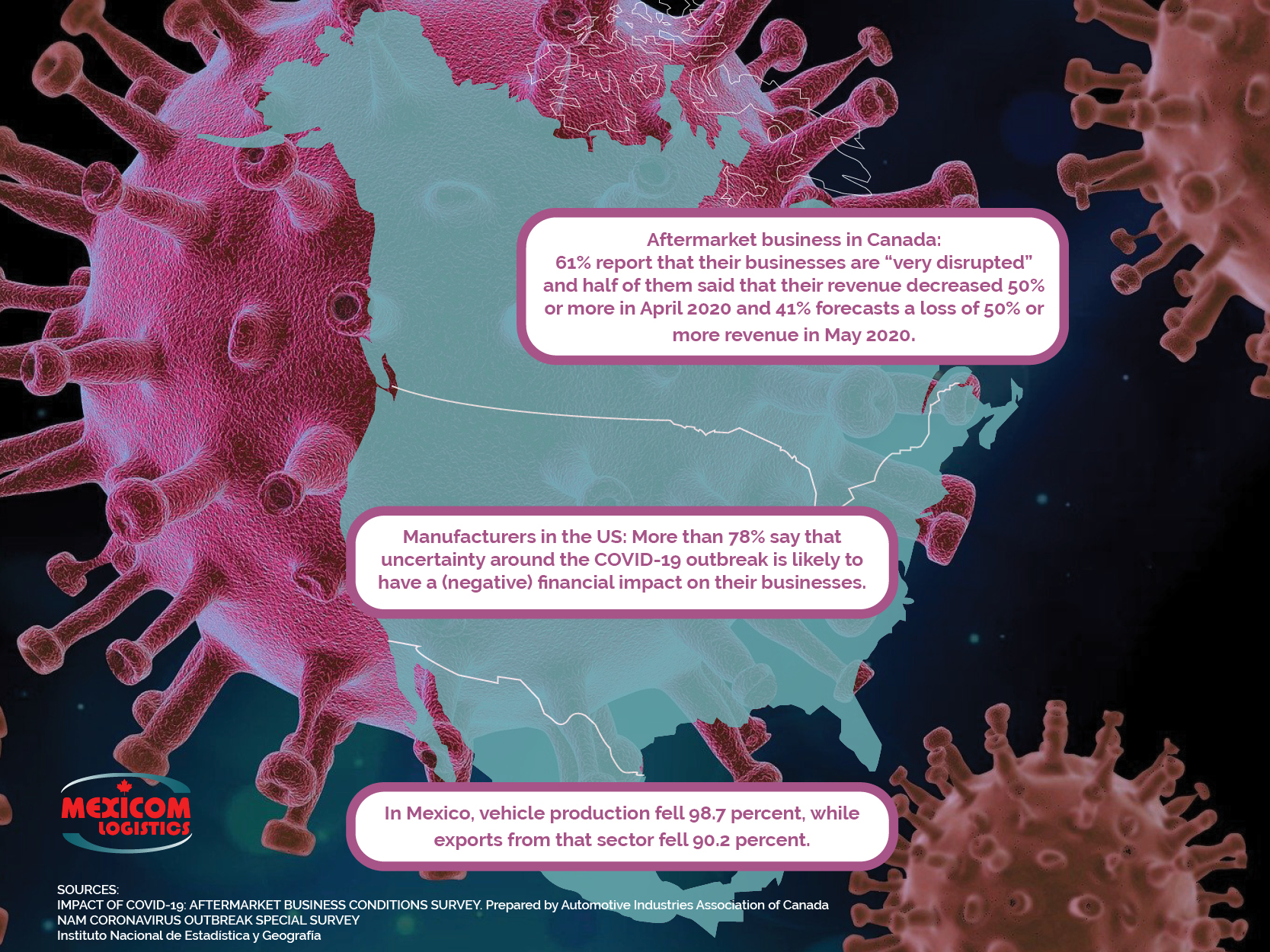

Manufacturers in the US: More than 78% say that uncertainty around the COVID-19 outbreak is likely to have a (negative) financial impact on their businesses

A recent survey made on Aftermarket business owners and employees across the 13 provinces and regions of Canada by the Automotive Industries Association of Canada reveals that

Aftermarket business in Canada: 61% of the respondents report that their businesses are “very disrupted” and half of them said that their revenue decreased 50% or more in April 2020 and 41% forecasts a loss of 50% or more revenue in May 2020.

Moreover, “the impact of reduced businesses has been swift and significant with over half the respondents having to lay off staff (61%)”.

In Mexico, the National Institute of Statistics and Geography (Inegi) reported that in April,

in Mexico, vehicle production fell 98.7 percent, while exports from that sector fell 90.2 percent.

With the result observed in April, the accumulative production in the first four months of the year decreased 29.5 percent compared to the same period last year.

In the United States, the unemployment rate on the transportation equipment manufacturing subsector went from 13.5% in January 2020 to 24.9 in April 202o.

On the computer and electronic product manufacturing subsector, it went from 1.8% in January 2020 to 3.5% in April 2020.

The pressure to open industries while Mexico is facing the most difficult moment of the pandemic

A misalignment on essential services policies, changes in the demand and supply, misalignment, or conflicting advice within single-country governments or between federal authorities in North American countries on POE practices, different health conditions in every country, as well as disparate degrees of the spread of COVID-19. All these conditions together result in different risks and vulnerabilities for businesses located in Mexico, the US and Canada and its supply chains.

Pressure has been put in the United States to urge Mexico to open the industries that are key to keep American business and government working.

“A letter from the National Association of Manufacturers dated Wednesday and signed by officials from more than 327 top foreign-based companies, the majority U.S. firms, was sent to President Andrés Manuel López Obrador, saying they are “deeply concerned about the health emergency decrees issued by Mexico’s Ministry of Health and state governments” that have resulted in threats to shutter, or actual closings of “essential manufacturing facilities, as well as those of our suppliers, imperiling our ability to deliver critical supplies and daily essentials to citizens in Mexico and across North America.”

“We particularly urge you to press your Mexican counterparts to incorporate industries providing components to the food, medical, transportation, infrastructure, aerospace, automotive, and defense sectors into their guidance”- Stated a letter sent by American Senators to the State Department of the US.

The requests arrive when Mexico is facing “the most difficult” moment of the pandemic. In May, Mexico recorded its largest rise so far in coronavirus cases.

Nevertheless, one day before the Government of Mexico had announced the inclusion of construction, mining and transportation manufacturing sectors as “essential”, as of May 18th, along with the release of its “New Normality” Plan to reopen social, educational and economic activities.

And one day after the largest one-day rise of COVID in Mexico, The Government of Mexico announced that automotive and auto parts industries dedicated to export, as well as other industries, could be able to reopen before June 1 if they carry out the process of establishing health safety protocols and mechanisms in accordance with health safety guidelines in the workplace.

The pressure to reopen key sectors came not only from international voices but also from domestic organizations in Mexico. Mexico’s Confederation of Industrial Chambers (Concamin) also called on the government to declare aerospace, automotive and electronics sectors as essentials.

Learn about the main effects on the supply chain identified by the manufacturing sector, in part 2 of this post:

How COVID-19 is disrupting supply chains in North America-What manufacturers are saying? – Part 2

Sources:

COVID-19 Canadian Supply Chain Issues

Global Economic Effects of COVID-19

https://www.wto.org/english/news_e/pres20_e/pr855_e.htm

Click to access d4fe3a6c-4ecb-4d96-a8d8-389c59ec0268.pdf

https://www.jornada.com.mx/ultimas/economia/2020/05/08/covid-19-desploma-produccion-y-exportacion-de-autos-en-abril-inegi-6226.html

https://www.bls.gov/iag/tgs/iag334.htm

https://www.bls.gov/iag/tgs/iag336.htm

https://www.cbc.ca/news/politics/coronavirus-supply-chains-1.5488730

Click to access gx-COVID-19-managing-cash-flow-in-crisis.pdf

Looking to reduce costs on freight transportation services?

Mexicom offers low rates on ground transportation between Mexico, the US and Canada