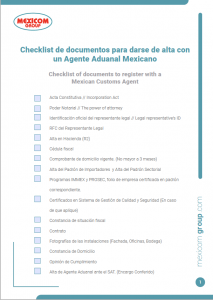

[Downloadable] Checklist of documents to register with a Mexican Customs Agent

In this article, we present you the list of documents you need to register with a Mexican Customs Agent. Make sure you have all the documents so that your registration with the customs agent is easier.

It is important to note that only Mexican companies, registered in the register of importers or exporters, can register with a Mexican customs agent.

When is it necessary to have a Mexican customs agent?

Article 40 of the Mexican Customs Law establishes that it is mandatory to use a customs agent for import or export operations.

- To import Mexico from Canada or the United States legally, you need to have a customs agent and be registered in the importers register.

- To export from Mexico to the United States or Canada, you need to have a customs agent and be registered in the exporters register.

What is a Customs Broker?

In simple terms, the customs agent represents importers and exporters before the Mexican Tax Administration Service and is in charge of the trade procedures and legislation for the clearance of merchandise.

The Mexican Tax Administration Service defines a Customs Agent as as:

Natural person whom the Ministry of Finance and Public Credit authorizes through a patent, to promote the clearance of merchandise on behalf of others, in the different customs regimes provided for in the Customs Law of whoever hires their services.

What do I need to register with a customs broker?

In this post, we give you a downloadable PDF with the list of documents necessary to register with a customs agent.

Likewise, we explain in detail what each of them consists of.

Click on the image to download the checklist

Acta Constitutiva // Incorporation Act

The Acta Constitutiva is the mandatory document that gives proof and legality to the constitution of a company at the time of creating a company. – Ministry of Economy, Mexico

To know what are the elements of a constitutive act, please, click here

Poder Notarial // Power of attorney

A Poder Notarial (power of attorney) is a document through which you authorize a person you trust to carry out various administrative and legal procedures in Mexico on your behalf, such as: buying, selling, notarizing or managing properties; withdraw money and manage bank accounts; register the birth of minors with their last name; among others. – Foreign Ministry, Mexico

Official identification of legal representative

According to the Tax Administration Service in Mexico, official identifications in Mexico can be:

In the case of Mexicans by birth or naturalized.

- Current voting ID, issued by the National Electoral Institute (formerly the Federal Electoral Institute).

- Valid passport.

- Valid professional license with photograph. Electronic professional certificates are excepted.

- Current ID of the National Institute for Older Adults.

- In the case of minors, the ID issued by Public or Private Education Institutions with recognition of official validity with photograph and signature, or the Personal Identity Card issued by the National Population Registry of the Ministry of the Interior, in force.

In the case of foreigners.

-

Corresponding current immigration document, issued by the competent authority (if applicable, extension or immigration endorsement).

RFC of the legal representative

The Registro Federal de Contribuyentes (Federal Taxpayer Registry), better known as RFC, is an alphanumeric code that the government uses to identify individuals and legal entities that carry out any economic activity in Mexico. – Ministry of Economy of Mexico

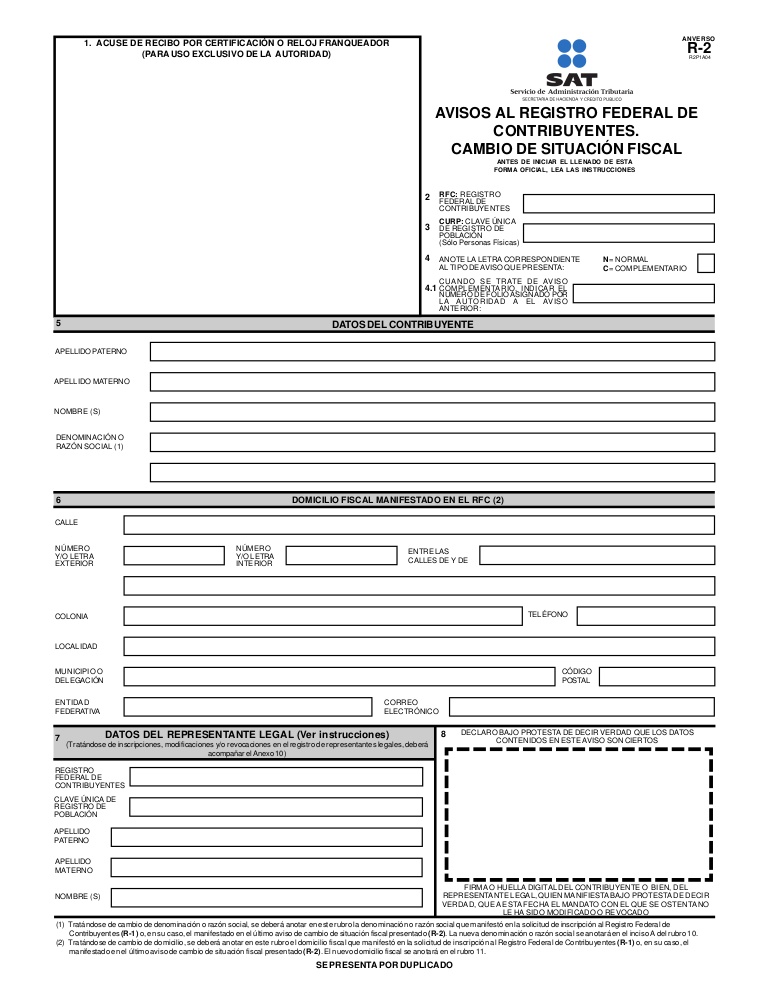

Alta en Hacienda – R2 // Registration in the Treasury – R2

It is a formulary for the “Notices to the federal registry of taxpayers change of fiscal situation”//”Avisos al registro federal de contribuyentes cambio de situación fiscal”.

Cédula Fiscal

It is a document that proves that a person, moral or physical, is registered in the Federal Taxpayers Registry of Mexico.

It contains a two-dimensional barcode (QR) that, when scanned by an intelligent electronic device, shows the following information: unique population registry key, name, denomination or company name, date of start of operations, tax situation, address and characteristics tax (regime and obligations). -SAT, Mexico

Here you can get the cédula fiscal.

Proof of residency

The Ministry of Finance and Public Credit of Mexico establishes that:

- Taxpayer’s Financial Statement provided by the institutions of the financial system, it must not be older than 4 months, it is not necessary that you show it paid.

- Last property tax receipt. It must not be older than 4 months, in the case of an annual receipt it must correspond to the current year, it is not necessary to show it paid.

- Last bill for electricity, gas, pay television, internet, telephone or water services, it must not be older than 4 months, it is not necessary to show them paid.

- Last settlement of the Mexican Institute of Social Security (IMSS).

- Contracts of:

- Leasing or subleasing signed by the taxpayer, in both cases, the lessor or sublessor must be registered and active in the RFC, and when the lessor or sublessor is a natural person, they must be registered in the leasing regime and attach a simple copy to the contract of your official identification. In this case, the lease must comply with the formalities required by legal provisions such as the name and signature of the parties that sign it, the purpose of the contract, the clauses and declarations to which they will be subject, to mention a few.

Provision of services on behalf of the taxpayer, which includes the use of an office or work space, subscribed with a minimum term of 6 months, accompanied by the payment receipt, which complies with tax requirements.

Trust formalized before a Notary Public.

Opening of a bank account signed by the taxpayer, no older than 3 months.

Electricity, telephone or water services subscribed by the taxpayer, must not be older than 2 months.

- Letter of residence issued by the state, municipal or similar governments in Mexico City, according to its territorial scope, which is not older than 4 months.

- Proof of alignment and official number issued by the state or municipal government or its similar in Mexico City, it must contain the tax address, no older than 4 months.

- Official receipt or payment order issued by the state, municipal or similar government in Mexico City, the receipt must contain your tax address, no older more than 4 months, in the case of annual payment it must correspond to the current year, it is not necessary that you show it paid.

- In the case of wage earners and taxpayers without economic activity, the current voting ID issued by the National Electoral Institute (formerly the Federal Electoral Institute), provided that the address is visible.

- In the case of registration in the RFC of foreign legal entities, they can present the authorization of the representative office or note of address, issued by the Ministry of Economy, provided that they contain the information of the address where the activities are carried out. This document must be issued in the name of the moral person.

Alta del Padrón de importadores de México y Alta del Padrón Sectorial // Registration to the Register of importers of Mexico and to the Sectoral Register

Registering in the Register of Importers is a must to import merchandise into the national territory.

Registration to the register of importers is free.

Click here to obtain more information and to register in the Mexican importers register

Folio de empresa Certificada en Padrón de Programas IMMEX y PROSEC

IMMEX Program

The IMMEX program provides holders the opportunity to temporarily import, free of import tax and VAT, the goods necessary for use in an industrial process or service to produce, transform or repair foreign goods temporarily imported for subsequent export or the provision of export services.

PROSEC Program

The PROSEC program allows the import of inputs with preferential tariffs for goods to be used in the production of products, regardless of whether they are destined for the local or international market.

Registration to the program is free.

Click here to sign up for the program

Constancia de Situación Fiscal // Proof of Tax Situation

It is a document that contains information from the Federal Taxpayer Registry and the Tax Identification Card. It can be obtained by individuals and legal entities that have an e.firma or password.

Click here to obtain your Constancia de Situación Fiscal

Constancia de Domicilio // Proof of address

The Proof of Address helps people or companies to prove their fiscal residence in Mexico.

You can obtain it here

Opinión de cumplimiento // Opinion on compliance

According to the Mexican Ministry of Finance,

The Opinion de cumplimiento with tax obligations in a positive sense helps you to access different procedures, authorizations, and benefits, in accordance with the provisions of article 32-D of the Federal Tax Code.

Click here to get it

Alta de Agente Aduanal ante el SAT – Encargo Conferido

El Encargo Conferido:

It allows you to increase and/or decrease the rights assigned to your customs agents, so that they can carry out your trade operations before the customs authorities.

Update it here

Useful resources:

Identificación Oficial:

https://www.sat.gob.mx/consulta/09381/consulta-los-documentos-que-son-aceptados-como-identificacion-oficial#:~:text=Cualquiera%20de%20los%20siguientes%3A%20Credencial,emitida%20por%20instituciones%20de%20educaci%C3%B3n.

Comprobante de domicilio:

https://www.sat.gob.mx/consulta/09382/consulta-los-documentos-aceptados-como-comprobantes-de-domicilio#:~:text=%C3%9Altimo%20recibo%20de%20los%20servicios,necesario%20que%20los%20exhibas%20pagados.

Padrón de importadores

https://www.sat.gob.mx/tramites/46063/inscribete-en-el-padron-de-importadores

Encargod Conferidos:

https://www.sat.gob.mx/tramites/19765/actualiza-tus-encargos-conferidos

![[Downloadable] Checklist of documents to register with a Mexican Customs Agent [Downloadable] Checklist of documents to register with a Mexican Customs Agent](https://mexicomlogistics.com/wp-content/uploads/bfi_thumb/dummy-transparent-rg1talopm5vqzufhfknfekzf15cxqqaozt80fj4ud4.png)