Everything you need to know about the DODA

If you transport freight from and/or to Mexico, it is likely that you have heard about the DODA. We have received many comments from our clients requesting more information about this document, which is relatively new in the freight transport processes across Mexican borders. We prepare this post in which we briefly explain everything you need to know about the DODA when transporting freight to Mexico.

What is DODA and why the Mexican government implemented it?

The Tax Administration Service (SAT) of the Mexican government launched the “Customs without papers” program, which is aligned with the customs facilitation schemes imposed by the World Trade Organization. The program seeks to streamline the processes of import and export of goods through the implementation of electronic systems. In this framework, the DODA or Document of Operation for Customs Clearance (Documento de Operación para Despacho Aduanero, in Spanish) is created. The DODA allows the dispatch of goods without presentation of the pedimentos, avisos or copias simples *.

The DODA has its legal basis the Mexican General Foreign Trade Rules for 2018 2.4.11 and 3.7.28. (Reglas Generales de Comercio Exterior para 2018, 2.4.11 y 3.7.28.) The document was enabled as of August 27, 2018.

What information does the DODA contain and how is it generated?

The DODA is generated only by customs figures, such as accredited legal representatives, agents or customs representatives. The DODA is created within the SAT’s website, with the following information:

- Customs and section CAAT number (carrier alphanumeric code)

- Transport identification number (Plates)

- Type of operation

- The information contained in the pedimentos previously paid and validated. This information can be captured within the SAT’s web portal or through the transmission of information through web services.

The DODA contains:

- A QR code (Quick response code)

- The electronic signature of the Customs Agent

- And the Digital stamp of the SAT, which is generated in the platform of tax administration of Foreign Trade.

How does the DODA work?

Importing of goods to Mexico

To cover the transfer of goods from their entry into national territory until their arrival at the final destination, it will be necessary to accompany the shipment with the DODA format.

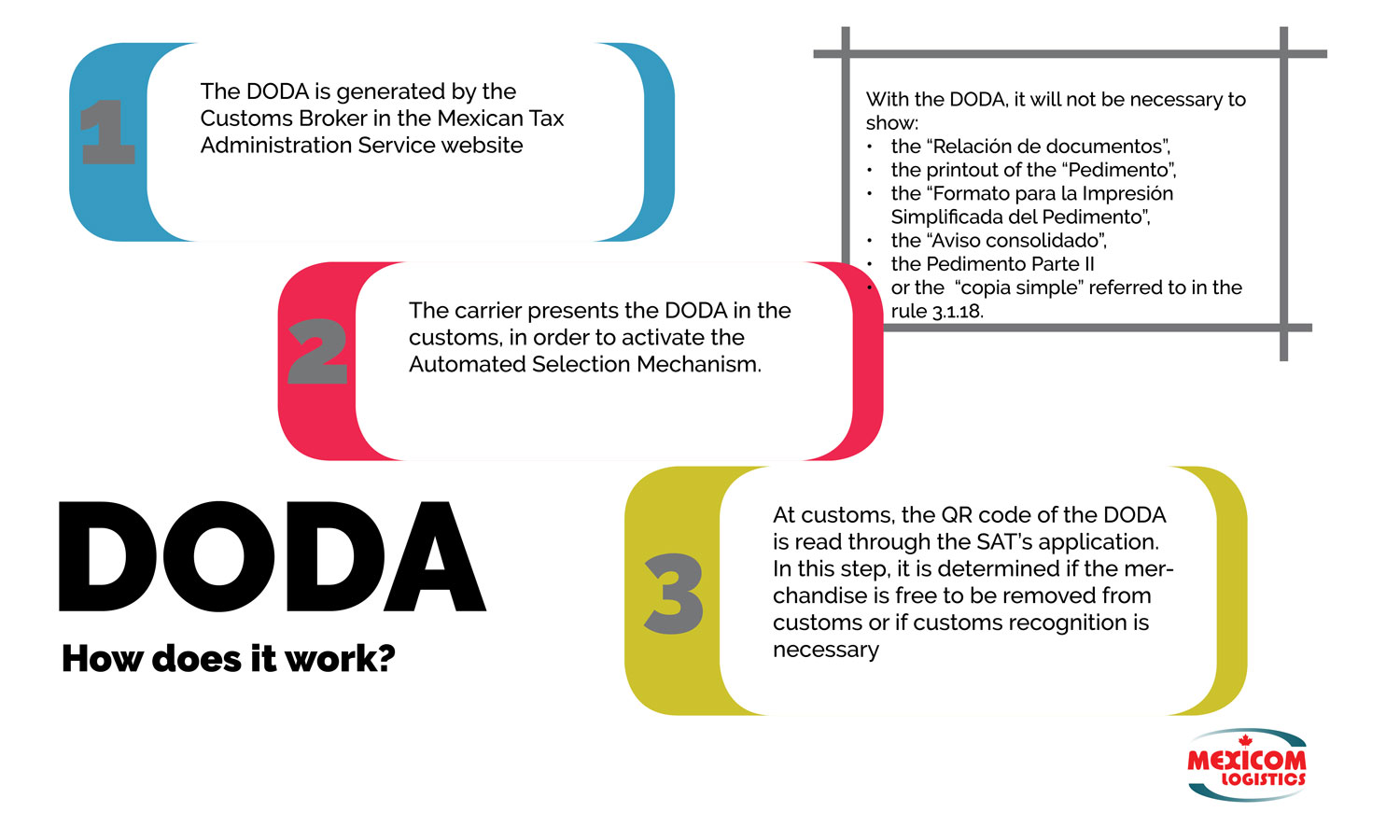

This is how the DODA works:

Brief explanation of how the DODA works

- The DODA is generated by the Customs Broker in the Mexican Tax Administration Service website

- The carrier presents the DODA in the customs, in order to activate the Automated Selection Mechanism.

With the DODA, it will not be necessary to show:

the “Relación de documentos”,

the printout of the “Pedimentos”,

the “Formato para la Impresión Simplificada del Pedimento”,

the “Aviso consolidado”,

the Pedimento Parte II

or the “Copia simple” referred to in the rule 3.1.18. - At customs, the QR code of the DODA is read through the SAT’s application. In this step, it is determined if the merchandise is free to be removed from customs or if customs recognition is necessary.

All documents that cover the merchandise contained in the same shipment must be grouped in the same DODA. A DODA must not be transmitted for each Customs document: a) Pedimento. b) Impresión Simplificada, c) Aviso de Consolidado d) Partes II. In other words, only one DODA must be generated for each vehicle.

In addition, the Pedimentos of different importers may be integrated in a single DODA, in accordance with Article 42 of the Customs Law Regulation.

Color of the DODA

The color in which the DODA should be printed depends on the destination of the goods

- White: Interior of Mexico

- Yellow: Border Strip

- Green: Border Region

Read also: The complete guide to shipping freight from the United States and Canada to Mexico

About the DODA in exports from Mexico to the United States

When exporting goods from Mexico to de US, the American documents will continue to be presented in the same way they are currently presented before the Automated Selection Mechanism.

In which cases should the DODA be generated?

In all types of operation and import and export regimes in which a pedimento, impresión simplificada, aviso consolidado or parte II is requested. The presentation of the DODA will be applicable only in the customs and customs sections that have the technological components that are requiered fot he use of the DODA.

Cases when the DODA should not be generated

- Transits

- Operations with copia simple in the rule 3.1.18

- Operations by means of rail transport

- “Aviso electrónico” operations

* When importing automotive vehicles, it is also necessary to generate and submit the DODA, however, it must be accompanied by the Pedimentos as an annex document.

Sources:

REGLAS Generales de Comercio Exterior para 2018

Confederación de Asociaciones de Agentes Aduanales de la República Méxicana, A.C.

Servicio de Administración Tributaria

Freight transportation between Mexico, the United States and Canada

Does DODA work ok for IMPO & EXPORT?

Hi Carlos,

Yes, it does. The program seeks to streamline the processes of import and export of goods through the implementation of electronic systems.

DODA should be generated in all types of operation and import and export regimes in which a pedimento, impresión simplificada, aviso consolidado or parte II is requested.

Excellent information