Projection of Freight Ground Transportation for the First Quarter of 2024 in Mexico, United States and Canada

As we cast our gaze into the first quarter of 2024 on the landscape of freight ground transportation. Including projected upswings in spot rates and the sustained trend of nearshoring, contribute to a positive outlook for the global economy. In this period of anticipation, various factors come into play, shaping expectations and influencing the trajectory of freight logistics.

As we delve into the first quarter of the year, we anticipate notable improvements in service levels driven by a combination of economic influences and innovative solutions entering the market. The previously experienced supply chain congestion, a consequence of the pandemic, has diminished, while transportation companies have fortified their service offerings, setting a positive trajectory for the coming months. Additionally, environmental stewardship is poised to command attention as companies work towards sustainability goals.

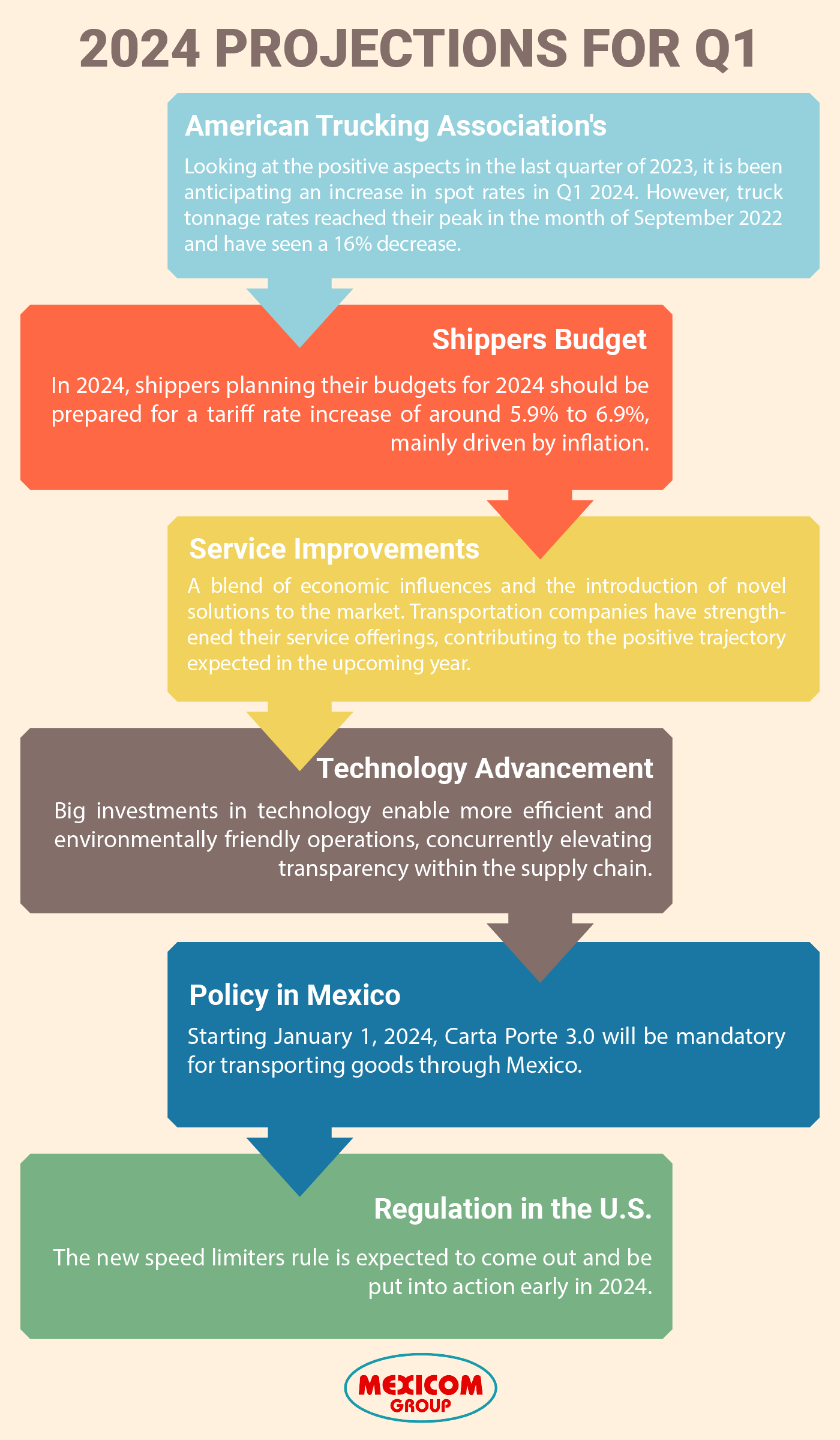

According to the American Trucking Association’s for-hire index, looking at the positive aspects in the last quarter of 2023, it is been anticipating an increase in spot rates in Q1 2024. However, making year-over-year comparisons is challenging, given that truck tonnage rates reached their peak in the month of September 2022 and have seen a 16% decrease.

In 2024, carriers are likely to raise their rates because of inflation and their strong control over business-to-business (B2B) and, to some extent, business-to-consumer (B2C) deliveries. Shippers planning their budgets for 2024 should be prepared for a tariff rate increase of around 5.9% to 6.9%, mainly driven by inflation.

In the context of optimistic developments for 2024, nearshoring stands out, with cross-border activity between the United States and Mexico expected to continue its upward trend. Shippers are increasingly diversifying their sourcing as a risk mitigation strategy. Nearshoring stands out as a positive aspect, with cross-border interactions with Mexico anticipated to keep increasing. Shippers are turning to diverse sourcing with Mexico as a strategy to reduce risks.

A key factor being presented is the manufacturing activity which is expected to rebound somewhat compared to a below-expectations 2023, and the relationship between inventory and sales appears to have stabilized. The combination of these factors allows for cautious optimism regarding the global economy in 2024.

Projected 2024 Industry Trends

The landscape of the freight transportation industry is undergoing significant transformations in 2024, with trends shaping the freight transportation industry for 2024.

Service Improvements

It is anticipated that during the first quarter of 2024, improvements are going to be seen in service levels, by a blend of economic influences and the introduction of novel solutions to the market. The previously encountered congestion in supply chains, stemming from the pandemic, has now lowered. Transportation companies have strengthened their service offerings, contributing to the positive trajectory expected in the upcoming year.

Sustainability Gains

Environmental stewardship is anticipated to take center stage for shippers. Firms will strive to fulfill their sustainability objectives, adhere to revised government guidelines, and respond to the expectations of an ever-growing climate-conscious customer demographic. Among the challenges shippers have to achieve their environmental targets, transportation emissions emerge as a prominent challenge.

Technology Advancement

Advancements in technology have driven enhancements in service and sustainability. Big investments in technology enable more efficient and environmentally friendly operations, concurrently elevating transparency within the supply chain.

Cross border between the U.S. and Mexico

Laredo, Texas will remain the most bustling entry port and is projected to experience further growth.

The value of trade passing through this border port has surpassed all other U.S. ports this year, totaling $241 billion in imports and exports from January to September of the current year (2023). This notable increase is credited to the practice of “nearshoring,” wherein companies relocate their supply chains closer to the U.S., frequently in Mexico just across the border from Laredo. The upswing in trade has expectations for continuous expansion in the future.

Reduced wait times at U.S. north and south border

Anticipated reductions in wait times for the North and South American border, accompanied by a decrease in the documentation necessary for border crossing. Non-U.S. citizens will no longer be obligated to provide proof of vaccinations when visiting the United States, as this requirement is set to conclude in 2023. This change is expected to facilitate smoother crossings for truck drivers commuting between Canada, Mexico and the U.S.

HIGHLIGHTS FOR 2024 IN MEXICO, THE U.S. AND CANADA

POLICIES IN MEXICO

Starting January 1, 2024, Carta Porte 3.0 will be mandatory for transporting goods through Mexico.

The updated version has new catalogs and improvements to make it easier to use. The details in this document are important for making trade more formal, preventing smuggling, and stopping unfair competition. Not using this document starting next year may lead to imposing fines on both the shipper and carrier.

REGULATIONS IN THE UNITED STATES

The new speed limiters rule is expected to come out and be put into action early in 2024.

In 2024, there will be a big boost in building projects because of the Infrastructure, Investment, and Jobs Act (IIJA), these projects were approved back in November 2021 and finally happen at the beginning of next year. More construction zones around the United States are to be expected.

The U.S. Freight Office in the Department of Transportation is taking the lead on matters related to moving goods, while the Supply Chain Center in the Department of Commerce is leading efforts related to important materials crucial for national security, and paying special attention to the supply chain.

CHALLENGES IN CANADA

Various challenges in the infrastructure sector contribute to ongoing difficulties. These challenges encompass traffic congestion and capacity issues, aging infrastructure requiring frequent repairs or replacement, as well as a deficiency in interconnectivity and alternative fuel sources, such as electricity. Labor shortages present an additional hurdle, while trade uncertainty introduces variables like shifting demand for region-specific goods, price fluctuations, and disruptions in supply chains. The persistent rise in inflation further compounds challenges, affecting the recruitment and retention of drivers, and escalating costs related to parts, equipment, facilities, and insurance premiums. This includes the expense of electronic logging devices, collectively eroding profitability for both insurers and transportation clients.

In conclusion, the first quarter of 2024 presents a promising outlook for freight ground transportation in North America, marked by projected upswings in spot rates and a sustained trend of nearshoring. Recognizing the difficulties of knowing what is coming towards this industry is most due to the fact it is always and is dependable on several factors. Despite this uncertainty, we look at the insights into the potential advantages and challenges that the upcoming year holds for the industry. While there are positive aspects anticipated, the outset of the year may also present certain challenges that demand careful consideration.

The freight transportation industry in 2024 is undergoing significant transformations, with service improvements driven by economic influences and innovative solutions. Supply chain congestion has diminished, and environmental has gained prominence, aligning with sustainability goals. Policies and regulations are set to shape the industry landscape in 2024, with a focus on efficient goods movement and national security.

SOURCES:

https://www.freightwaves.com/news/a-freight-market-turnaround-in-2024https://www.westlandinsurance.ca/news/transportation-logistics-industry-2024-outlook/