[Infographic ] Is there really a diesel shortage? Why did diesel prices increase more than oil prices?

Why did diesel prices increase more than oil prices?

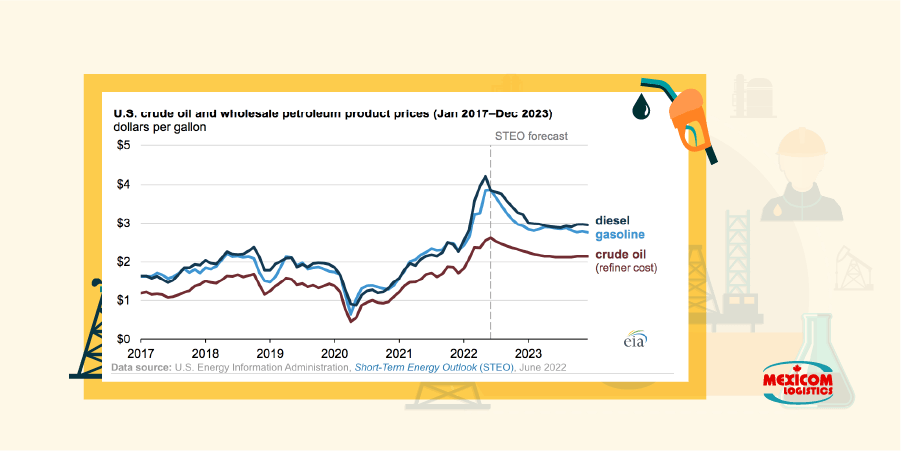

Diesel is made from crude oil and from biomass materials. That is why oil and diesel prices are generally closely associated. However, in recent months we have seen diesel prices increasing at a higher rate than the prices of the crude oil used to make them. What is the reason for the difference between the price of crude oil and the prices of refined products, known as crack spread?

The reason for diesel prices skyrocketing while oil costs are not increasing at the same rates is the value of refining crude oil. The difference in prices reflects the refining margins and profitability, which have been increasing in 2022.

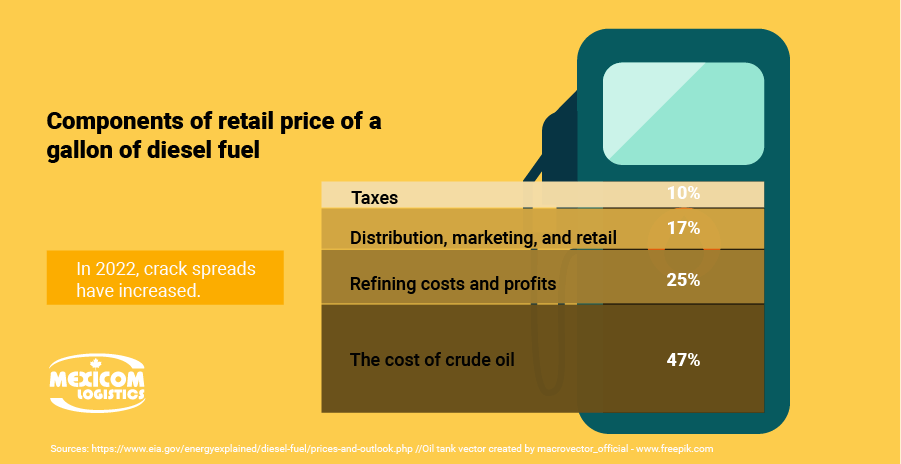

Components of the retail price of a gallon of diesel fuel

According to the U.S. Energy Information Administration, four main components contribute to the retail price of a gallon of diesel fuel:

- The cost of crude oil purchased by refineries accounts for 47% of diesel retail price.

- Refining costs and profits represent 25%.

- Distribution, marketing, and retail station costs and profits constitute 17%.

- Taxes (federal, state, county, and local government) account for the remaining 10%.

However, in 2022, the refining costs and profits have increased.

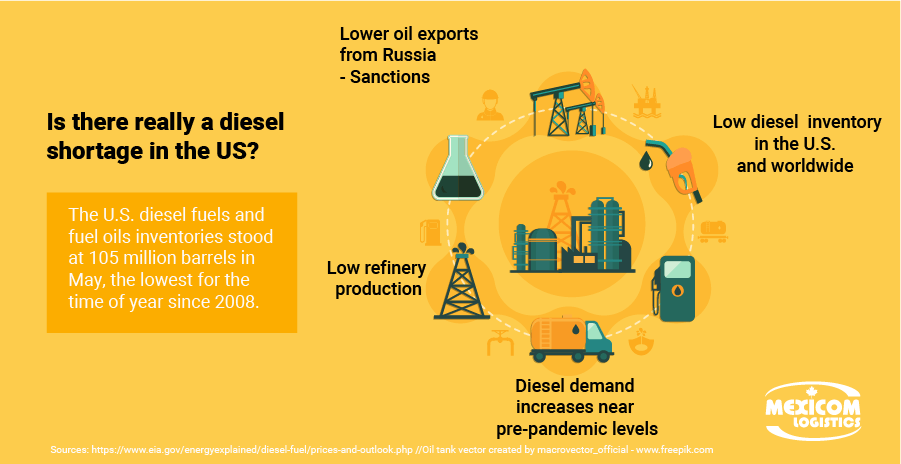

Is there really a diesel shortage in the US?

Diesel prices and refining margins and profitability are above the historical average because of several factors. One of them is the low inventories. The U.S. diesel fuels and fuel oils inventories stood at 105 million barrels in May, the lowest for the time of year since 2008.

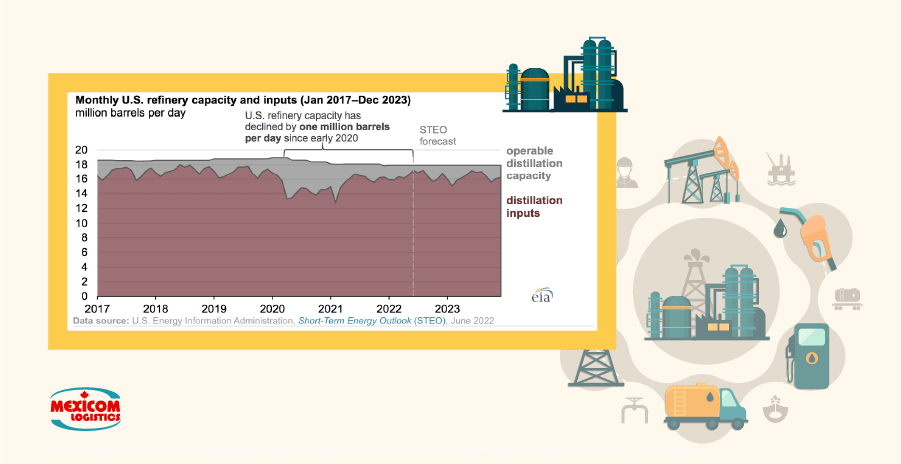

Other factors include the fuel demand increases combined with the low refinery production of fuels compared with pre-pandemic level. After confinement measures to prevent COVID-19 spread have been lifted, fuel demand increased again. However, supply had already dropped. And the resumption of hydrocarbon production is not instantaneous, it is a complex issue that involves not only time and money but also social license.

“We expect that refinery utilization will reach a monthly average level of 96% twice this summer, near the upper limits of what refiners can consistently maintain. We expect refinery utilization to average 96% in June, 94% in July, and 96% in August.” – U.S. energy Information Administration

Finally, the recently announced European ban on Russia’s energy imports contributes to tightening even more the already low inventories.

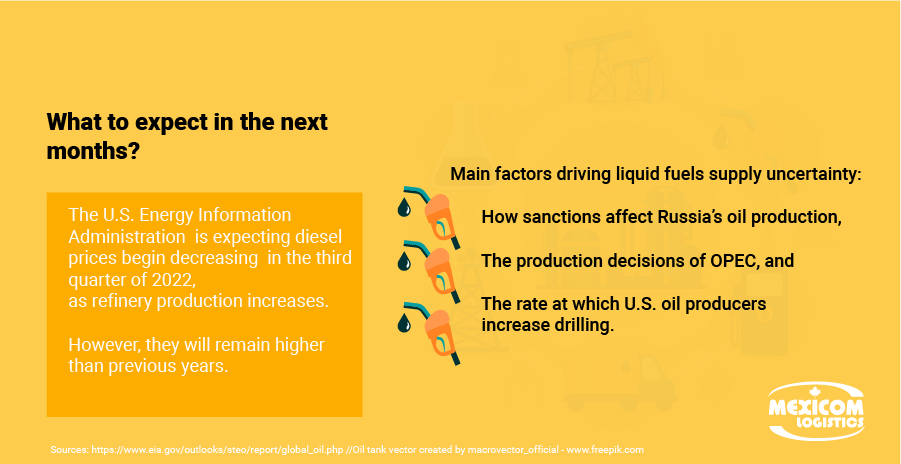

What to expect in the next months?

The U.S. Energy Information Administration is expecting diesel prices to begin decreasing in the third quarter of 2022, as refinery production increases. However, they will remain higher than in previous years.

In general, the supply and demand of oil are primarily affected by levels of oil consumption, oil reserves, and global exchange rates. However, factors such as environmental issues, politics, and oil speculation in the financial markets also play an important role. Right now, there are three main factors driving liquid fuels to supply uncertainty:

- how sanctions affect Russia’s oil production,

- the production decisions of OPEC, and

- the rate at which U.S. oil and natural gas producers increase drilling.

![[Infographic ] Is there really a diesel shortage? Why did diesel prices increase more than oil prices? [Infographic ] Is there really a diesel shortage? Why did diesel prices increase more than oil prices?](https://mexicomlogistics.com/wp-content/uploads/bfi_thumb/dummy-transparent-rg1talopm5vqzufhfknfekzf15cxqqaozt80fj4ud4.png)