Q4 2024 Trucking & Economic Forecast: What to Expect in the Final Stretch of the Year

As 2024 comes to a close, the trucking and logistics industries are experiencing significant shifts. Changes in the global economy, evolving consumer behaviors, and various market conditions are all influencing freight demand. This article explores the key factors driving these trends and examines how different stakeholders—carriers, shippers, and third-party logistics providers (3PLs)—are adapting to the current landscape.

Key Factors Impacting Freight Demand

1. Slowing Global Economy: Ongoing challenges such as the aftermath of the pandemic, inflation, and geopolitical tensions have contributed to a deceleration in global growth. Consumer spending is projected to decline by 4% in Q4, alongside a reduction in industrial production, leading to decreased demand for freight services.

2. High Interest Rates: Inflation has compelled central banks to maintain elevated interest rates, averaging around 5%. This situation has made borrowing more costly, prompting businesses to defer investments and consumers to reduce spending, resulting in fewer goods being transported.

3. Changes in Consumer Spending: As society transitions beyond the pandemic, there is a noticeable shift in consumer spending towards experiences—such as travel and dining—rather than physical goods. This change has resulted in a 3% decrease in freight demand compared to the previous quarter.

4. Supply Chain Disruptions: Although there have been some improvements in supply chains, unpredictability remains an issue. Events such as natural disasters or abrupt changes in trade can disrupt logistics, complicating the movement of goods.

5. Excess Truck Capacity: The recovery of the economy has not occurred as swiftly as anticipated, leading to a surplus of trucks within the industry. Current excess truck capacity has increased by 6%, contributing to low trucking rates despite rising costs for fuel, labour, and insurance.

Factors Contributing to Low Demand for Consumer Goods

Several factors are contributing to the decline in freight demand for consumer goods:

– High Inflation: With inflation rates around 6%, consumers are reducing non-essential purchases. This leads manufacturers and retailers to decrease production and inventory levels, resulting in fewer goods being shipped.

– Conservative Inventory Management: Many businesses are adopting conservative inventory strategies to mitigate risks associated with unpredictable consumer demand, resulting in fewer shipments.

– Reduced Manufacturing Output: Production has decreased, particularly in sectors such as automotive and aerospace. Rising costs coupled with declining consumer demand have led manufacturers to scale back output, further reducing the volume of freight transported.

Coping Strategies of Logistics Stakeholders: Carriers, Shippers, and 3PLs

Each segment of the logistics chain faces distinct challenges this quarter. Below is an overview of how carriers, shippers, and 3PLs are responding to the prevailing market conditions:

Carriers

Carriers are grappling with rising costs in fuel, labor, and insurance, which have increased by approximately 8% year-over-year. Additionally, new emissions regulations have further elevated operational expenses. Despite these challenges, weak demand and an oversupply of trucks have led to a 5% decline in average freight rates compared to the same period last year, making profitability increasingly difficult.

While there is some optimism regarding a potential increase in demand during the holiday season, the overall market is expected to remain sluggish, with no significant recovery anticipated.

Shippers

Shippers are leveraging new technology to enhance their supply chains and improve operational efficiency. Advanced tools, such as transportation management systems, are being adopted to facilitate better decision-making. Notably, major companies like Amazon and PepsiCo are expanding their logistics services to support other businesses.

With declining consumer demand, shippers have been able to negotiate more favorable agreements with carriers. Freight contracts have seen an average rate reduction of 4%, and many shippers are securing long-term contracts at lower rates to capitalize on current market conditions.

Third-Party Logistics Providers (3PLs)

The 3PL sector has experienced considerable consolidation, with larger providers acquiring smaller competitors to expand their operations. Recent acquisitions include Transfix by NFI and XRO’s purchase of Coyote Logistics. In parallel, 3PLs are increasing their technology investments to enhance efficiency and service offerings, with tech spending rising by 12%.

3PLs are combining traditional logistics relationships with modern technology advantages. By incorporating automation, data analytics, and digital platforms, they are maintaining competitiveness despite the sluggish overall market.

Economic Landscape in the US and Expectations for Q4 2024

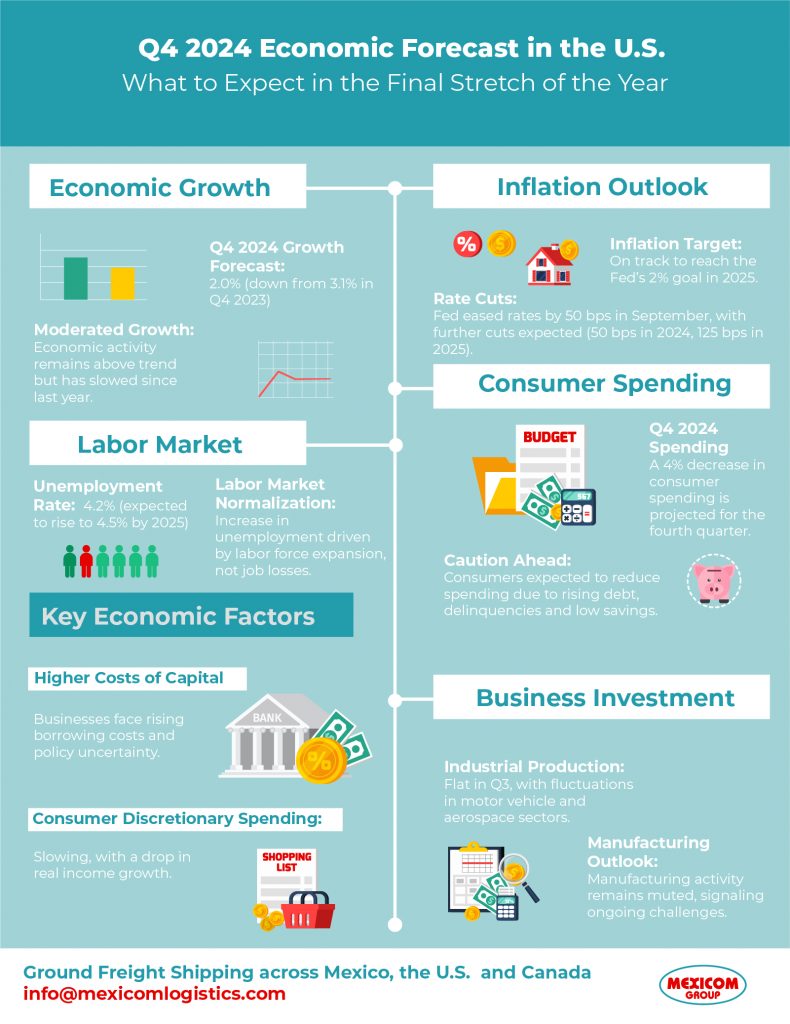

As we approach the end of 2024, the economic outlook reflects a moderate growth rate, projected at 2.0% for the fourth quarter, a decrease from 3.1% in the same period last year. Despite ongoing sluggishness in the housing and manufacturing sectors, recent indicators suggest that economic growth momentum remains slightly above trend, albeit with a noticeable moderation since last year.

The labour market is showing signs of normalization, which has led to an increase in the unemployment rate to 4.2%, a shift primarily driven by an expansion of the labour force rather than a decline in employment. This trend is a critical distinction from previous cycles that heralded the onset of recessions. Nevertheless, real income growth has softened, and discretionary consumption is beginning to slow down. Given the lack of anticipated changes in tax policy, particularly in personal income taxes, it is expected that public sector contributions to GDP and employment growth will be tempered, even as infrastructure spending continues.

Businesses are grappling with higher costs of capital and policy uncertainties, which are likely to constrain capital expenditure and hiring in the near term. Consequently, the unemployment rate may rise to 4.5% by the end of 2025.

Inflation Trends

Forecasts indicate that inflation is expected to further decline in the coming months, with labour market normalization contributing to a decrease in unit labour costs and an increase in labour productivity. Inflation expectations among households, businesses, and financial markets align with the Federal Reserve’s target of 2%. Although the path ahead may be uneven, annual inflation is projected to hover close to this target in 2025, barring any unforeseen supply shocks.

The Federal Reserve’s approach to monetary policy is currently not predetermined. However, with the inflation target appearing increasingly achievable, the Fed’s risk management perspective has shifted to prioritize labor market stability. Following a 50-basis point rate cut in September, further easing of 50 basis points in 2024 and an additional 125 basis points in 2025 is anticipated.

Consumer Spending Insights

Consumer spending has shown resilience, bolstered by strong core retail sales and a rebound in motor vehicle sales earlier in the year. Signs of a cooling labour market and real income growth lagging behind spending growth since mid-2023 raise concerns about sustainability. With the household savings rate at a two-year low and rising delinquency rates for credit cards and auto loans, consumers are expected to rein in their spending in the forthcoming quarters.

Business Investment Spending

In terms of business investment, industrial production has remained flat in the third quarter, with notable fluctuations in sectors such as automotive manufacturing. A recent 0.9% month-over-month increase in manufacturing production was primarily attributed to a 9.8% rise in motor vehicle production, following a prior decline due to temporary retooling shutdowns. However, the sustainability of this rebound remains uncertain, especially given the ongoing challenges, including the Boeing strike and subdued manufacturing activity indices from various sources.

Expectations for the Trucking and logistics industry Q4 2024

Neutral sentiment about fourth-quarter revenue dropped 4.3% and negative expectations rose 7% from the last survey, BlueGrace Logistics said.

As the final quarter of the year approaches, the trucking and logistics sectors are expected to face ongoing challenges. Freight demand is anticipated to remain low, with minimal changes in the movement of consumer goods. The holiday season may provide a slight increase in shipments, but it is unlikely to reverse the overall downward trend. Economists forecast a potential drop in freight volumes of 2-3% compared to Q3, particularly as consumer spending tightens.

Carriers will continue to encounter pressure on freight rates due to excess truck capacity. Shippers are likely to take advantage of this situation by negotiating favourable contracts. Meanwhile, 3PLs will persist in their technology investments to enhance efficiency and maintain a competitive position within a challenging market.

Sources:

https://www.spglobal.com/ratings/en/research/articles/240924-economic-outlook-u-s-q4-2024-growth-and-rates-start-shifting-to-neutral-13258419https://www.fleetmaintenance.com/equipment/article/55132285/trucking-executive-predictions-for-for-2024-peak-seasonhttps://www.freightwaves.com/news/april-cass-data-shows-no-improvement-in-freight-demand