[UPDATED] Navigating Trade Tensions: The Potential Impact of Trump’s Tariffs on US-Mexico-Canada Trade and Supply Chains

President Donald Trump’s trade policies have been a key factor in the reconfiguration of economic relations between the United States, Mexico, and Canada.

In this article, we explore Trump’s most significant statements and actions regarding trade with Mexico and Canada, and the implications for supply chains and citizens in these countries.

Update as of February 3 at 10:30 AM ET:

LATEST DEVELOPMENTS:

- U.S. President Donald Trump has imposed new tariffs on imports from Mexico and Canada, setting a 25% duty on most products and a 10% rate specifically for Canadian energy resources.

- In response, Canada initially implemented a 25% tariff on U.S. imports starting Tuesday, affecting products such as beverages, cosmetics, and paper goods, valued at 30 billion Canadian dollars ($20 billion USD). A second list of goods subject to tariffs is expected to be released soon, including passenger vehicles, trucks, steel and aluminum products, certain fruits and vegetables, beef, pork, dairy products, aerospace items, and more. These goods are estimated to be worth 125 billion Canadian dollars ($85 billion USD).

- Mexico has announced retaliatory tariffs but has not yet specified the rates or the products that will be affected.

FEBRUARY 3:

- Mexican President Claudia Sheinbaum stated that Donald Trump agreed to delay the implementation of the 25% tariffs on Mexico for one month after a phone call in which she committed to deploying 10,000 National Guard members at the border.

- Canadian Prime Minister Justin Trudeau spoke with U.S. President Donald Trump in the morning regarding the looming trade war. They are expected to communicate again later in the day. Neither the Prime Minister’s Office nor the White House immediately released details about the conversation.

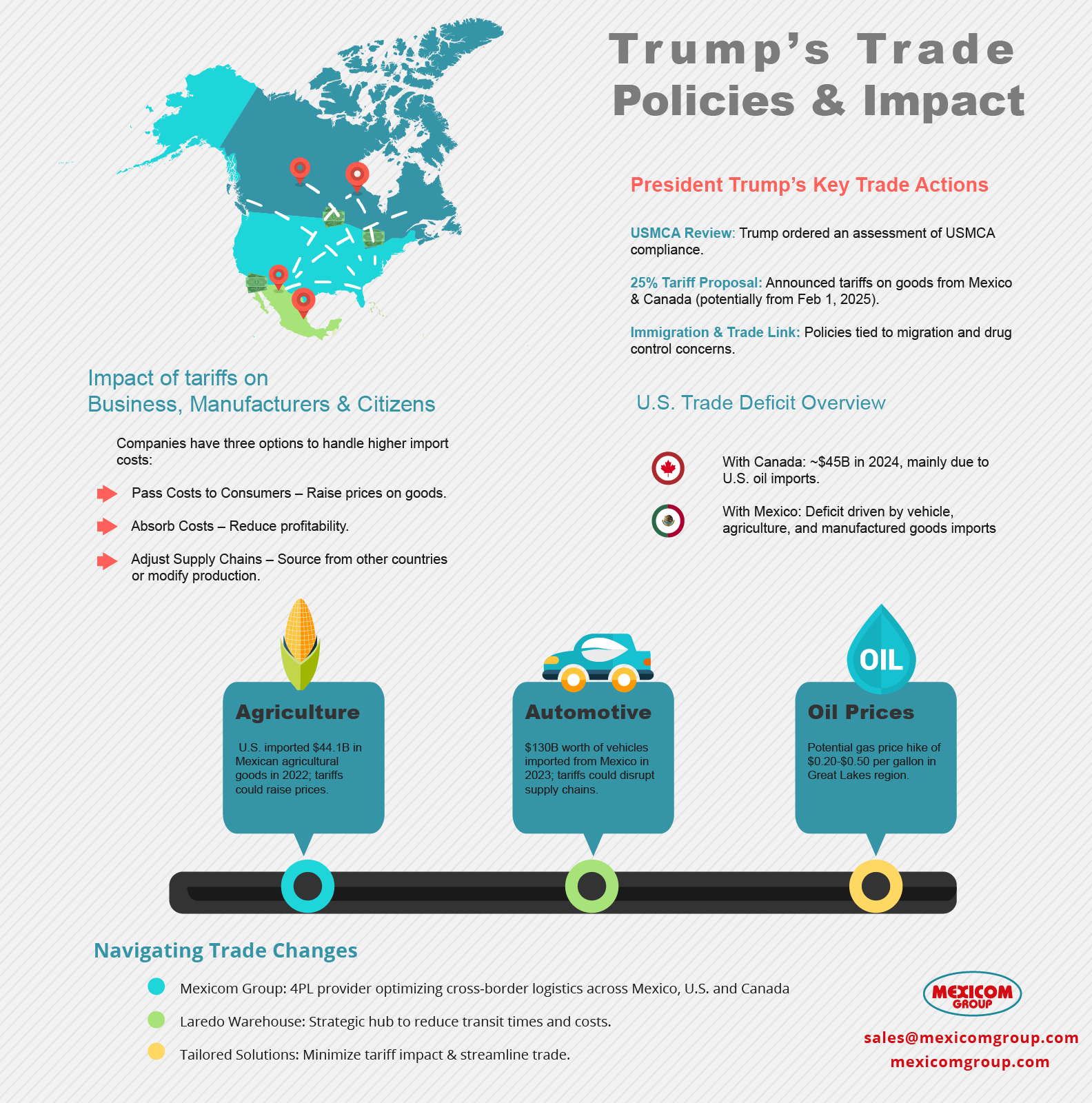

Key Actions and Statements from Trump on Trade with Mexico and Canada

- USMCA Compliance Review: One of Trump’s orders to assess compliance with the United States-Mexico-Canada Agreement (USMCA), the trade deal designed to replace the North American Free Trade Agreement (NAFTA). The USMCA was particularly focused on the impact on American farmworkers, ranchers, and related service providers.

Trump’s executive will direct agencies to assess China’s compliance with its 2020 trade deal with the U.S., as well as the status of the U.S.-Mexico-Canada Agreement, or USMCA, Reuters reported.

- 25% Tariff : Trump said he will impose a 25% tariff on goods imported from both Canada and Mexico, a move that could dramatically alter trade flows between the three countries. Although this tariff was not part of his day-one executive orders, he indicated that it might be implemented as early as February 1, 2025.

- Focus on Immigration and Drugs: Trump’s trade policies are often coupled with other measures, such as assessing the flow of immigrants and drugs from Mexico and Canada into the U.S. These concerns were at the heart of his approach to trade negotiations and tariff decisions.

The context of the trade relationship between the U.S., Mexico, and Canada: What is the trade deficit?

The trade relationship between the United States, Mexico, and Canada is a cornerstone of North America’s economic integration, with the three nations linked through a complex web of interdependence.

Bilateral relations: The U.S. is the main trading partner of both Mexico and Canada, with a trade balance that varies across sectors. The trade deficit is the term used when a country imports more than it exports. In the case of the U.S., its deficit with Mexico in manufactured and agricultural products is considerable, while with Canada, although a deficit also exists, it is much smaller.

Trade deficit with Canada:

The U.S. trade deficit, particularly in its dealings with Canada, has often been a point of contention, especially under claims of a “massive” trade imbalance. While former President Trump has repeatedly pointed out that Canada exports more to the U.S. than it imports, it’s essential to consider the complexity behind these numbers.

As highlighted by TD Economics, the U.S. shortfall with Canada is projected to be around US$45 billion in 2024, which is considered the second-smallest trade deficit among major U.S. trading partners, including China and Mexico, with deficits of US$192 billion and US$130 billion, respectively. One key factor contributing to this deficit is the U.S. demand for energy-related products from Canada, which balances out a significant portion of the trade relationship. In fact, TD economists Marc Ercolao and Andrew Foran argue that if it weren’t for energy, the U.S. would actually run a trade surplus with Canada.

This understanding of the U.S.-Canada trade dynamic is in contrast to the broader picture of trade deficits, which aren’t simply about the balance of goods and services. As Hendrix Vachon, principal economist at Desjardins Group, points out, trade deficits are deeply connected to consumer spending, investments, and government deficits. In the case of the U.S., high consumer spending—accounting for roughly 70% of GDP—drives much of the country’s trade deficit. This is in stark contrast to Canada, where consumer spending only represents 55% of GDP. Additionally, lower government spending and a lack of a public health-care system contribute to the U.S. maintaining a growing current account deficit.

In essence, the trade deficit isn’t just a result of imbalances in exports and imports, but also reflects larger economic dynamics, including consumer habits, investments, and governmental policies. To truly address the deficit, the U.S. would need to make structural changes to one of these components. As Vachon explains, “In reality, the United States won’t really be able to reduce its trade deficit unless it also chooses to reduce one of these three components.”

Trade deficit with Mexico:

The deficit with Mexico, in particular, has increased due to the growing import of manufactured products, vehicles, and agricultural products. Trump has focused his strategy on reducing this deficit, primarily through the imposition of tariffs.

In 2024, the U.S. faced a trade deficit with both Mexico and Canada, but these deficits are often smaller when compared to the U.S.’s deficit with other countries such as China.

Trump’s Trade Deficit Claims on Canada: Economic Facts and Canada’s Response

Trump has repeatedly claimed that the U.S. faces a “massive” trade deficit with Canada, asserting that the U.S. imports more from Canada than it exports.

During the World Economic Forum, Trump declared:

“We have a tremendous deficit with Canada. We’re not going to have that anymore”… “Canada has been very tough to deal with over the years and it’s not fair that we should have a $200 billion-$250 billion deficit. We don’t need them to make our cars … we don’t need their lumber … we don’t need their oil and gas.”

However, economists note that this claim overlooks the role of U.S. demand for energy products, particularly oil, which heavily influences trade balances.For instance, Canada is the leading supplier of oil to the U.S., with 71% of U.S. crude oil imports coming from this country in 2023. The implementation of tariffs could directly affect fuel prices in the U.S., particularly in regions dependent on Canadian crude, such as the Great Lakes.

Finance Minister Dominic LeBlanc has said that Canada is prepared for Trump’s actions. “One thing we’ve learned is that President Trump at moments can be unpredictable,” LeBlanc declared.

“We have spent the last number of weeks preparing potential response scenarios for the Government of Canada in partnership with provinces and Canadian business leaders and union leaders. So our country is absolutely ready to respond to any one of these scenarios.”

What’s at Stake for Mexico in Trump’s Tariff Policies

Mexico’s trade relationship with the U.S. is also critical, particularly in industries such as agriculture and automotive manufacturing. Here’s how Trump’s tariffs could affect Mexico:

Agricultural Exports: Mexico is a major supplier of agricultural products to the U.S. In 2022, the U.S. imported $44.1 billion worth of agricultural products from Mexico, accounting for about 20% of all U.S. agricultural imports. Trump’s proposed tariffs could lead to higher prices for products like avocados, with 89% of U.S. avocado imports coming from Mexico.

Automotive Trade: Mexico’s automotive industry plays a vital role in supplying the U.S. with vehicles and parts. In 2023, the U.S. imported $130 billion worth of vehicles from Mexico. A 25% tariff on these goods would significantly increase costs for U.S. consumers and could disrupt the automotive supply chain, especially since many U.S. automakers rely on parts manufactured in Mexico.

Last year, Mexico’s president Claudia Sheinbaum sent sends a letter to Donald Trump, mentioning: “It is not with threats or tariffs that the migration phenomenon or drug consumption in the United States will be addressed. What is needed is cooperation and understanding.”

Supply Chain and Consumer Impact of Tariffs

The potential tariffs could have significant consequences for both supply chains and U.S. consumers, as businesses and governments attempt to navigate the increased costs.

- Increased Consumer Prices: One immediate effect of tariffs is the potential for higher prices on goods, especially in industries where Mexico and Canada are key suppliers. For example, oil prices could rise by 20-50 cents per gallon in regions most reliant on Canadian crude.

Unless Canadian oil is excluded from the tariffs, gas prices could jump by 20 to 50 cents a gallon in the Great Lakes region because refineries there are most reliant on Canadian oil, Patrick De Haan, head of petroleum analysis at GasBuddy.

Impact on Manufacturers and Retailers: Companies in the U.S. would have three main options to deal with the increased costs of imported goods – PWC:

-

- Passing Costs to Consumers: Businesses may choose to raise prices on finished goods, which could impact consumers directly.

- Absorbing the Costs: Some companies may absorb the costs themselves, risking reduced profitability.

- Supply Chain Adjustments: Companies could alter their supply chains, either by sourcing from other countries or changing production processes to mitigate the tariff impact.

Mexicom Group can help you navigate the complexities of trade relations between Mexico, the U.S. and Canada

Mexicom Group, a 4PL freight transportation provider specializing in ground shipments between Mexico, the U.S., and Canada, can help shippers navigate the complexities of trade relations and tariff changes. With years of expertise in cross-border logistics,The Mexicom Group of companies offers tailored solutions that mitigate the impact of tariffs and optimize supply chains.

Mexicom USA strategic location in Laredo, Texas, a key entry point for shipments between the U.S. and Mexico, provides shippers with a state-of-the-art warehouse facility that can streamline operations. With our 4PL solutions, clients can reduce transit times, lower inventory costs, and ensure timely deliveries while navigating potential disruptions caused by trade policies. This end-to-end solution empowers shippers to maintain efficiency and reduce overhead, even amidst fluctuating trade conditions.

Sources

- Columbia Business School

- “Why Targeting Mexico and Canada Could Mean Higher Prices”

Source

- “Why Targeting Mexico and Canada Could Mean Higher Prices”

- Reuters

- “Trump’s tariff and trade policies”

Source

- “Trump’s tariff and trade policies”

- Global News

- “Canada’s response to Trump’s tariff threats”

Source

- “Canada’s response to Trump’s tariff threats”

- Financial Post

- “Trump’s tariff tirade against Canada challenged by charts”

Source

- “Trump’s tariff tirade against Canada challenged by charts”

- CNN

- “Where gas prices could rise due to tariffs on Canadian and Mexican oil”

Source

- “Where gas prices could rise due to tariffs on Canadian and Mexican oil”

- Twitter (Claudia Sheinbaum)

- “Letter to Trump”

Source

- “Letter to Trump”

- CNN Español

- “Impacto de los aranceles a México y Canadá”

Source

- “Impacto de los aranceles a México y Canadá”

- PwC

- “Impact of tariffs on US companies with manufacturing operations in Mexico”

Source

- “Impact of tariffs on US companies with manufacturing operations in Mexico”

![[UPDATED] Navigating Trade Tensions: The Potential Impact of Trump’s Tariffs on US-Mexico-Canada Trade and Supply Chains [UPDATED] Navigating Trade Tensions: The Potential Impact of Trump’s Tariffs on US-Mexico-Canada Trade and Supply Chains](https://mexicomlogistics.com/wp-content/uploads/bfi_thumb/impact-of-trumps-tariffs-on-us-mexico-canada-trade-and-supply-chains2-r0qb7coustejjvlwt32dabhhyu4lz73pct245oklo8.jpg)