Maximizing Efficiency in Cross-Border Manufacturing Supply Chains when nearshoring in Mexico

La version française de ce document sera bientôt disponible.

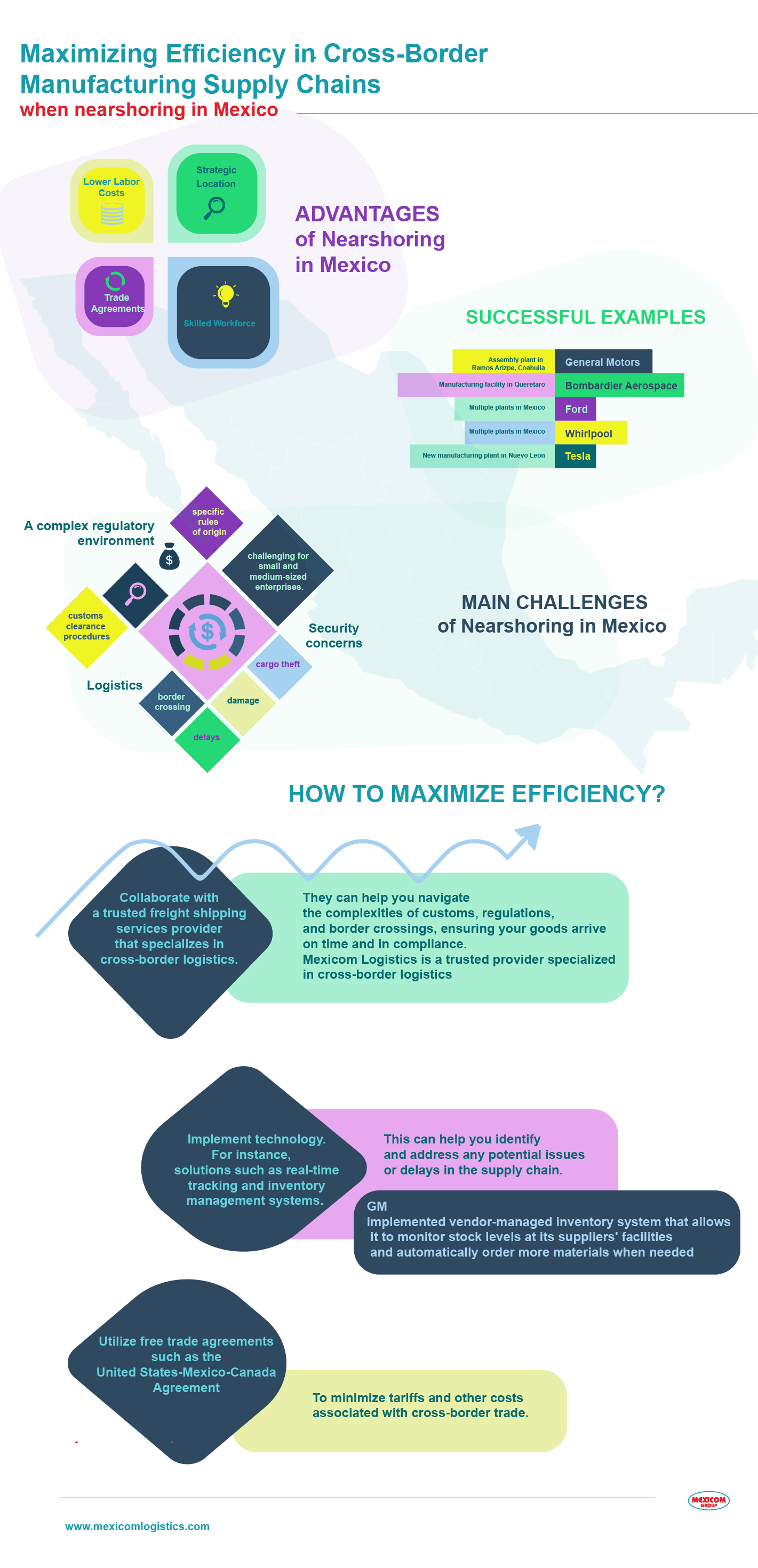

Are you a manufacturing company looking to optimize your cross-border supply chain? Are you nearshoring in Mexico? As trade continues to flourish between Mexico, the US, and Canada, many manufacturing companies have opted to nearshore their operations in Mexico to take advantage of the country’s lower labor costs, strategic location, and favorable trade agreements. In this post, we will present examples of successful companies nearshoring in Mexico, the challenges they face, and the strategies that they have implemented to successfully maximize efficiency in their cross-border manufacturing supply chains.

Nearshoring in Mexico

As companies expand their operations globally, nearshoring in Mexico has become a popular strategy for manufacturing companies. With its lower labor costs, skilled workforce, and favorable trade agreements, Mexico has become an attractive location for Canadian and American companies looking to expand their manufacturing operations.

One of the main advantages of nearshoring in Mexico is the lower labor costs compared to Canada and the US. The country’s strategic location also makes it an ideal location for companies to manufacture and distribute products throughout North America.

The growth of Mexico’s manufacturing industry has had a significant impact on the freight shipping industry as well. With the increase in production and trade, there has been a growing demand for freight transportation services to transport goods between Mexico, the US, and Canada.

Find further information about Nearshoring in our blog post:

- Why US and Canadian firms are moving manufacturing from Asia to Mexico? What is Nearshoring?

Examples of Companies Expanding Nearshoring in Mexico

There are several examples of companies that have expanded their operations in Mexico to take advantage of the benefits of nearshoring. For instance, General Motors (GM) has invested heavily in Mexico, expanding its operations to produce cars for the North American market. In 2021, GM announced a $1 billion investment to expand its operations in Mexico, including the creation of a new assembly plant in Ramos Arizpe, Coahuila. Currently, the GM Ramos Arizpe plant manufactures the ICE-powered Chevy Blazer and Chevy Equinox crossovers, while the Equinox is also built at the GM San Luis Potosí plant in Mexico.

Another example is Bombardier Aerospace, a Canadian company, that has established a manufacturing facility in Queretaro, Mexico. This facility produces airplane parts that are then shipped to the US and Canada for assembly. Similarly, American company Ford has multiple plants in Mexico that produce vehicles for the North American market.

Whirlpool, a leading manufacturer of home appliances. The company has been operating in Mexico for more than 30 years and has multiple manufacturing plants across the country. In 2021, Whirlpool announced a $15 million investment in its Monterrey plant to expand its production of refrigerators and other appliances.

Finally, Tesla has recently opened a new manufacturing plant in Nuevo Leon, Mexico, which is expected to produce 100,000 electric vehicles per year. Tesla’s decision to establish its Gigafactory in the state of Nuevo León has generated job opportunities and has strengthened Mexico’s position as a competitive destination for manufacturing companies.

Main Challenges of Nearshoring in Mexico

Manufacturing companies that ship products between Mexico, the US, and Canada face various challenges in their supply chains. These challenges can range from regulatory compliance to logistical issues, including transportation, customs clearance, and security.

Challenge #1 of Nearshoring in Mexico: A complex regulatory environment for trade between Mexico, the US, and Canada

One of the biggest challenges that manufacturers face is the complex regulatory environment for trade between Mexico, the US, and Canada. Companies need to comply with regulations in each country, which can be time-consuming and expensive. For instance, the United States-Mexico-Canada Agreement (USMCA), which came into force in July 2020, has specific rules of origin that companies must follow to qualify for tariff-free trade. Ensuring compliance with these rules can be a challenge, especially for small and medium-sized enterprises.

Challenge #2 of Nearshoring in Mexico: Logistics

Another challenge is logistics. Transporting goods between Mexico, the US, and Canada can be complicated due to different transportation modes and infrastructure. Additionally, the border crossing can be time-consuming and congested, leading to delays and increased costs. For instance, in 2021, the Mexican government implemented new measures to improve safety and reduce congestion at the border, including the implementation of new software to expedite customs clearance procedures. However, these measures may take time to fully implement and may still result in delays for manufacturers.

Challenge #3 of Nearshoring in Mexico: Security concerns

Moreover, there are security concerns when shipping goods between countries. Companies need to ensure that their products are protected against theft or damage during transport. In recent years, there have been incidents of cargo theft in Mexico. These incidents can disrupt the supply chain and lead to significant financial losses.

How can companies nearshoring in Mexico maximize efficiency in their cross-border manufacturing supply chain?

Here are a few key strategies:

Strategy #1 to maximize efficiency in cross-border manufacturing supply chains

Collaborate with a trusted freight shipping services provider that specializes in cross-border logistics. Providers such as Mexicom Logistics can help navigate the complexities of customs, regulations, and border crossings, ensuring your goods arrive on time and in compliance.

Example: Mexicom Logistics helps efficiently manage manufacturing cross-border supply chains

An example is the collaborative work between a trusted freight shipping services provider Mexicom Group of companies and its customers. Mexicom Group specializes in maximizing efficiency in cross-border supply chains between Mexico, the US and Canada. Mexicom Group has develop an unique model that consists of 3 companies, each of them specialized in one area of the supply chain. TransMexicom, help companies nearshoring in Mexico to make more efficient and safe the transportation of their products between Laredo or main ports of Mexico and main Metropolitan Areas in Mexico. Mexicom USA, is the American company that focuses on all logistics operations in the Mexico-US border crossing. While, Mexicom Logistics, manages the overall transportation of goods between the 3 northamerican countries. This model allows Mexicom Group to have a highly specialized team that has helped near 3000 companies to understand the complexity of shipping from and to Mexico, and face various challenges, including compliance with regulations, logistical issues, and security concerns.

Strategy #2 to maximize efficiency in cross-border manufacturing supply chains

Implement technology solutions such as real-time tracking and inventory management systems. This can help you identify and address any potential issues or delays in the supply chain.

Example: GM implements technology to optimize its supply chain efficiency in Mexico

In addition to investing in the expansion of its operations in Mexico, GM has also implemented several strategies to optimize its supply chain efficiency. For example, the company has implemented a vendor-managed inventory system that allows it to monitor stock levels at its suppliers’ facilities and automatically order more materials when needed. GM has also implemented advanced analytics to track inventory levels and optimize its production schedule to ensure timely delivery of finished vehicles.

Strategy #3 to maximize efficiency in cross-border manufacturing supply chains

Utilize free trade agreements such as the United States-Mexico-Canada Agreement (USMCA) to minimize tariffs and other costs associated with cross-border trade.

Example: A Mexican-based company, Grupo Bimbo, and an US-based company, General Mills partnered to expand their cross-border trade by utilizing the benefits of the USMCA. By taking advantage of the agreement’s provisions on rules of origin, the companies were able to minimize tariffs and other costs associated with cross-border trade. This allowed them to increase the efficiency of their supply chain, reduce costs, and expand their market share in North America.

In conclusion, manufacturing companies that transport goods between Mexico, the US, and Canada face various challenges, including compliance with regulations, logistical issues, and security concerns. However, there are solutions available, such as technology adoption and working with specialized logistics providers. Recent examples of commercial trade between the three countries demonstrate the importance of improving cross-border transportation to facilitate economic growth and enhance international trade. Building strong partnerships with key suppliers and logistics providers is crucial for a successful cross-border manufacturing supply chain.

Mexicom Logistics has worked together with a great number of companies to help them navigate the nearshoring in Mexico challenges and provide solutions to help companies manage their supply chains more efficiently. Mexicom Group consists of 3 companies, each of them specializes in one area of the cross-border supply chain management between Mexico, the US and Canada.

Sources:

- https://bombardier.com/en/media/news/bombardier-learjet-85-aircraft-composite-structure-manufacturing-take-place-queretarol

- https://www.americanindustriesgroup.com/news/general-motors-announced-investing-more-than-1-billion-coahuila/

- https://mexiconewsdaily.com/news/whirlpool-to-invest-us-120-million-in-coahuila-plant/

- https://www.cnn.com/2023/03/01/business/tesla-mexico-plant/index.html

- https://ustr.gov/trade-agreements/free-trade-agreements/united-states-mexico-canada-agreement#:~:text=The%20United%20States%2DMexico%2DCanada%20Agreement%20(USMCA)%20entered,farmers%2C%20ranchers%2C%20and%20businesses.